Articles by Francesca Veronesi

Platina buys Cap Vital Sante

France-based Cap Vital Sante was previously owned by the founder and members of the network

Active Capital's FTNon sold to trade for €32m

US-based JBT Corporation acquires Dutch FTNon, the industrial food equipment provider

Pechel backs Vernicolor

Pechel buys a minority, while founding CEO François Champier and management retain the remainder

Alven, Idinvest inject $45m into Meero

After a funding round in Q4 2017, commercial photography specialist Meero attracts new capital

Amundi Private Equity backs Appart Fitness

France-based gym operator will bolt on its peer Nextalis following the capital injection

CM-CIC et al. inject €53.5m in Socomore

CM-CIC and Ace recommit to France-based Socomore, Raise and BPI France are new backers

Societe Generale Capital Partenaires backs Netcom

Three founders retain their majority stake in the France-based telecommunications operator

Demeter backs Piscines Magiline in MBO

UI Gestion, BPI France, Esfin Gestion and BTP Capital remain backers of Piscines Magiline

Gilde Equity Management acquires Eiffel

Transaction sees founder Ferdi van Dommelen exit his investment in the Dutch consultancy

Quilvest reshuffles management

Alexis Meffre takes over from Stanislas Poniatowski as Quilvest's executive chairperson

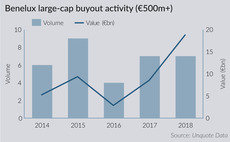

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures

Naxicap's Technicis bolts on HL Trad

Idinvest Partners' single-tranche loan supports translation service HL Trad's acquisition

NorthEdge's SME Fund I closes on £120m

NorthEdge's small-cap-focused vehicle, launched in February 2018, hits £120m hard-cap

Marlborough opens office in Madrid, hires head of Iberia

PwC's Pedro Manen de Sola-Morales will become managing director and head of Iberia

Ontex rejects PAI's takeover offer

Board of directors rejects offer on the basis that it undervalues Belgium-based Ontex

Andera et al. back Dynacure in €47m round

Investors support the biotech business in advancing its lead programme into clinical development

Raise to back Artemis Courtage

Raise Investissement typically invests €10-50m in companies generating a €30-500m turnover

Investec hires HSBC's Burgess

Burgess will focus on origination and execution of private debt services across Europe

Hivest buys St Mamet in SBO

Florac sells stake in canned fruits specialist Saint Mamet having invested in 2015

Chevrillon & Associés buys DCW Editions

Chevrillon provides equity tickets in the €5-75m range for businesses valued at between €200-250m

Cinven's Chryso buys Ruredil

Chryso, a producer of additives for concrete and cement, buys assets from Italy-based Ruredil

MBO Partenaires backs Laboratoires Embryolisse

French GP provides a €16m ticket for the transaction, which values Embryolisse at between €50-100m

Weinberg's Pharma Omnium sells Biodim subsidiary

Apax Partners' NuPharm acquires France-based Laboratoire Biodim from its parent company

PE-backed Neovia sold to trade in €1.53bn deal

Eurazeo, Unigrains and Idia owned Neovia alongisde French cooperative group InVivo