Articles by Katharine Hidalgo

ADC Therapeutics gathers $76m in series-E extension

Headquartered in Lausanne, ADC Therapeutics has raised $531m since its inception in 2012

Target Global, IGP lead €50m series-C for McMakler

Previous investors include Lakestar, DN Capital, Earlybird, Warpspeed Ventures and Frog Capital

Haspa BGM acquires Braase

Small-cap investor Haspa BGM invests in Germany-headquartered companies with revenues of €10-300m

VCs invest $12m in Scoutbee

VCs HV Holtzbrinck Venture, 42Cap and Toba Capital invested $4m in the company in 2018

KKR launches offer for Axel Springer at €63 per share

Friede Springer and CEO Mathias Döpfner, who hold 45.4% of shares, will form a consortium with KKR

CIC backs Mega Gossau

CIC Capital has acquired a minority stake with the management team retaining a majority

Atomico leads €88m round for Infarm

Existing investors Balderton Capital, Cherry Ventures and TriplePoint Capital participate

YFM invests £5m in Tonkotsu

YFM used equity from its British Smaller Companies VCT and VCT 2 funds for a minority stake

Houlihan Lokey appoints Collinson

Collinson joins from William Blair's European consumer and retail investment banking department

HTGF et al. invests in Simreka

Sap.IO, Sap's early-stage investment arm, also invested in Simreka with High-Tech Gründerfonds

Legalisation of e-scooters gives German startups green light

Germany is the last of 11 European countries to legalise e-scooters, even though it has already seen the largest number of funding rounds in Europe

Steadfast Capital backs BUK and UHB

Steadfast Capital invests in lower-mid-market companies with enterprise values of between €20-150m

Mutares to acquire Kico

Germany-based Mutares invests in companies with small profits and revenues of €50-500m

Fortino backs Maxxton

Fortino is currently investing from its Fortino Growth Capital II vehicle, which has raised €125m

Earlybird et al. in €15m series-A for Getsafe

Earlybird is currently investing from its Earlybird Digital West Fund VI, which closed on €175m

WCAS exits Aim Software in €60m deal

Welsh, Carson, Anderson & Stowe acquired a majority stake in Aim Software in 2015

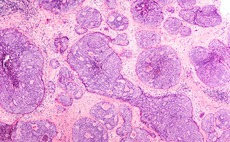

IBB and E.On invest in Nuventura

Consortium of IBB, E.On, Apex Energy Teterow and business angels have invested €3-7m in Nuventura

Wineus Capital acquires Zurrfix

Wineus typically provides investments of between CHF 5-30m for SMEs in Switzerland

Volpi appoints Investindustrial's Klasmeyer

Klasmeyer has worked at Lazard, Morgan Stanley, Pamplona Credit Mangament and Bain Capital Credit

Auctus-backed Magellan Netzwerke acquires Solit Systems

Magellan Netzwerke was acquired by Auctus in 2016 and became part of Fernao Networks

Waterland-backed Rehacon bolts on Fysioconcept

Waterland acquired a majority stake in physiotherapy provider Rehacon in January 2019

Triton-backed AVS bolts on Fero

Triton bought AVS from Steadfast Capital in 2017, drawing equity from its €3.3bn vehicle Triton IV

DPE to exit First Sensor for approximately €117m

DPE, Teslin Capital Management and other shareholders have agreed to sell their shares

KKR, Axel Springer could target Scout24, Mobile.de – reports

KKR confirmed it is in negotiations to acquire a minority stake in Axel Springer