Articles by Harriet Matthews

Aurelius buys Panasonic Europe's consumer battery business

Company will operate under a new name but with a production and distribution licence from Panasonic

Gimv acquires Verkley from PHM Investments

Gimv has acquired Netherlands-based underground energy and water cable and pipeline specialist Verkley from PMH Investments.

Main Capital acquires Foconis

GP plans to support add-ons for the financial services software platform as part of its growth

Earlybird heads for Growth Opportunities final close

European VC investor is also fundraising for its latest Digital West and Health funds

Emeram, Gimv acquire Sofatutor; VC backers exit

Previous investors in the online learning platform include Acton Capital, Frog Capital and IBB

VCs in $170m round for trading platform Bitpanda

According to Unquote Data, the round is the largest ever recorded for an Austrian company

Triton Smaller Mid-Cap Fund II closes on €815m

Fund will follow the same sector and value-creation strategy as TSM I, albeit with larger equity tickets

DACH Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the DACH market, including Capiton, Afinum, Gyrus, Cipio, and more

DBAG's FLS merges with Impactit, Städtler Logistik

All three route-planning and logistics software companies will now operate as Solvares Group

Capiton buys majority stake in Wundex

Wound care product supplier was a portfolio company of BE Beteiligungen prior to the sale to Capiton

HIG sells Infinigate to Bridgepoint

HIG invested in the cybersecurity service in 2017 and supported its European expansion

Aurelius acquires Hüppe

GP expects the shower enclosure producer's future growth to benefit from ongoing consumer trends

Triton invests in NPM Capital's Bergman Clinics

Investment is being made in partnership with NPM Capital and the Malenstein family

Kerogen sells Zennor Petroleum to trade

Kerogen Capital acquired a majority stake in Zennor in 2015, investing alongside Unigestion

Equistone sells Oikos to Goldman Sachs

Equistone acquired the prefabricated housing company in an SBO from Adcuram in 2018

Tikehau opens Frankfurt office, hires Felsmann

ABN Amro's Dominik Felsmann will take up his role as Tikehau's head of Germany from 15 March

Bid Equity's Myneva bolts on Patronis, TTS

Social care and healthcare software platform is following a buy-and-build strategy

Paragon sells NovumIP to GP-backed Questel

Transaction will see Paragon invest in Questel for a minority stake in the IP consultancy firm

Inflexion buys minority stake in Systal

Investment in the managed IT network service is the GP's third deal to be announced in March 2021

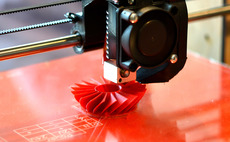

AM Ventures holds first close for 3D printing venture fund

Additive manufacturing-focused venture capital firm has a target of €100m for the vehicle

BGF-backed TIG bolts on ThirdSpace

Acquisition of the cybersecurity and identity firm is backed by BGF and Santander Growth Capital

Consortium in $400m series-C for Hopin

Virtual event software was valued at $2.1bn at the time of its $125m round in November 2020

Cadence Growth Capital hires Kamphans

Niko Kamphans is to join the B2B technology-focused GP as an investment professional

Pride Capital sells stake in Kairos to trade

Direct lender invested in Kairos in 2018 and was part of Main Capital until its spin-out in 2019