Articles by Harriet Matthews

Unigestion invests in Afinum-backed bakery chain Zeit für Brot

Majority owner Afinum will transfer its stake in the company from its 2017-vintage Fund 8 to its newest fund

Ambienta plans asset class expansion following EUR 1.55bn Fund IV close

Environmental investor set for first deals with new fund in 2023 as it assesses a foray into new asset classes and geographies, founder and managing partner Nino Tronchetti Provera tells Unquote

AM Ventures holds EUR 100m final close for debut fund

Industrial additive and 3D printing VC expects to make two to three deals this year

ACP holds EUR 90m first close for debut credit fund

Fund aims to bridge the lending gap for Central European lower mid-cap businesses, complementing existing bank lending

Nest mandates HarbourVest for PE investing

Workplace pension scheme has made its second PE mandate following its partnership with Schroders

Waterland names van Cauwenberghe as next group managing partner

Cedric Van Cauwenberghe will succeed Frank Vlayen in 2023 and will head the GP's day-to-day running

DPE-backed building service provider Calvias files for insolvency

GP had placed the technical building service provider up for sale in late 2021, according to Mergermarket

COI Partners launches DACH growth fund with EUR 120m target

GP's first institutional fund will invest on a 50:50 basis alongside the sponsor's own deal-by-deal vehicles

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

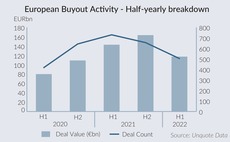

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Motive raises USD 2.54bn across Fund 2 and co-investment vehicles

GP's USD 1.8bn Fund 2 is 3.7x the size of its predecessor and expects to make 15-18 deals

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller

Siparex holds EUR 450m final close for ETI 5

Mid cap-focused fund is 60% larger than its 2017-vintage predecessor and has made four investments

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

Algebris holds EUR 200m first close for debut Green Transition Fund

Fund has a EUR 400m target and is headed by three former executives from Italian utility company A2A

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Howden hires KPMG’s O’Connor, launches capital advisory business

New group aims to address its clients’ need for complex insurance and investment solutions

Capza launches SME decarbonisation fund with EUR 1.3bn target

Second vintage of the SME-focused strategy will aim to support its portfolio companies with decarbonisation

Earlybird names three new Digital West partners

Andre Retterath and Paul Klemm are existing team members, while Vincenzo Narciso joins from Px3 Partners

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments

Mutares-backed Nordec cancels Finland IPO

Sponsor acquired steel construction supplier Donges Group and subsidiary Nordec in 2017

Plural holds EUR 250m final close for debut early-stage fund

VC firm is led by technology founders Ian Hogarth, Khaled Heloui, Sten Tamkivi and Taavet Hinrikus

Acton Capital holds Fund VI first close, expands investment team

VC firm has hired Sophie Ahrens-Gruber in Munich and appointed Hannes Gruber as partner in Vancouver

Secondaries GPs expect record 2022 – Investec

Fifth Secondaries Market Report also reveals that 97% of secondaries investors are participating in GP-leds