Articles by Harriet Matthews

DPE's AWK Group buys Talos

Deutsche Private Equity bought a 55% stake in IT consultancy AWK in 2017 via its third flagship fund

ELF hires Wimpff as investment director

Florian Wimpff joins the direct lending firm from ESO Capital and also has experience at Herter & Co

Highland Europe launches $706m Technology Growth IV

GP held a final close for Highland Europe Technology Growth III in June 2018 on тЌ463m

CrossEngage announces €6.5m growth capital round

Marketing software company also announces merger with Target Partners' GPredictive

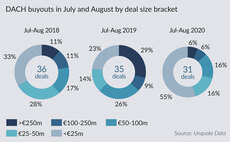

DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow, Unquote gauges market sentiment as to whether activity could pick up before year-end

Eos Capital Partners holds final close for debut fund

GP has so far invested in companies in industrial automation, software and business training

Consortium in €21m round for Magazino

Logistics company Jungheinrich has led the round for the robotics company alongside EIB

Parcom in talks to acquire Equistone's Group of Butchers – report

Mergermarket reported that the original sale process fell through as the pandemic took hold

DBAG partially realises investment in Pfaudler

Pfaudler's listed subsidiary, GMM Pfaudler, acquires an 80% stake in the business

VC-backed Snyk acquires BtoV portfolio company DeepCode

Cyber security software Snyk raised $200m at a $2.6bn valuation earlier in September 2020

Triton's AVS Verkehrssicherung bolts on SRV Verkehrstechnik

Traffic safety and management company has announced eight add-ons since Triton's 2017 investment

3i buys majority stake in GartenHaus

E-commerce company expects to benefit from the growing popularity of leisure and gardening products

Nord Holding acquires Bock

Deal is a carve-out from Bock's listed owner, GEA Group, which acquired the company in 2011

Ampersand Capital Partners invests in GeneWerk

Pharmaceuticals-focused GP aims to support GeneWerk's growth to meet demand for its services

Ergon's SVT Group buys Odice

Deal sees the fire protection products manufacturer expand in France and brings its turnover to €200m

Apax sells Neuraxpharm to Permira

Deal values the company at more than €1.6bn and is set to generate returns for Apax of 3.5x money

Rede Partners appoints Ellul as chairman

Firm has also hired associate principals Etiene Ekpo-Utip in the UK and Matthew Zuckerman in the US

LBO France's RG Safety buys Waterfire

Deal is the protective equipment producer's second add-on in Spain since the GP invested in 2017

Bid Equity's Myneva Group buys Swing

Bid Equity began its social care and healthcare software buy-and-build strategy in 2017

Siparex, BPI France sell Duralex to trade

Firms invested in the business in 2015 alongside management, acquiring it from Initiative & Finance

Afinum buys majority stake in Listan

Computer cooling and energy efficiency hardware company is Afinum's fourth buyout of 2020

Evolution Equity on the road for second fund – report

New York-headquartered venture capital firm held a final close for its debut fund in 2017 on $125m

LGT Lightstone leads €144m round for Infarm

Round for the urban farming startup is the fourth-largest of 2020 in the DACH region

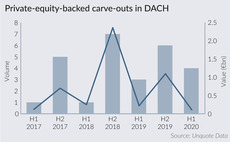

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs