Articles by Katharine Hidalgo

Campbell Lutyens promotes Patel to partner

Placement agent has also promoted Vincent Ragosta to principal in its New York office

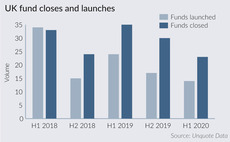

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Planet First Partners acquires stake in Polymateria for €16.5m

Polymateria is expected to reach sales of тЌ33m in 2021, according to a report

TowerBrook acquires Azzurri in £70m deal

Azzurri owns the ASK Italian, Zizzi and Coco di Mama chains and is based in London

Bridgepoint in talks to acquire WSL

Twelve member clubs of WSL, including Manchester City, Arsenal and Chelsea, would also take stakes

CGE acquires Enhesa in debut deal

Founded in 2001, Enhesa is an environmental, health and safety compliance intelligence platform

Newlands, Hermes GPE invest in Capsule

Manchester-based Capsule generates 60% of its sales outside the UK, including 20% in the US

Target Global et al. co-lead £20.5m round for Drover

Target Global is currently investing from is Target Global Early Stage Fund II, which closed on тЌ120m

BGF invests £2.7m in The Paint Shed

Management is planning to create an additional 20 jobs over the next 24 months

LP platform Titanbay launches

Titanbay has a 1% set up fee for clients and a 0.5% annual maintenance fee

CommerzVentures invests $6m in Concirrus

Company intends to use the funds to expand operations and its business reach

Draper Esprit leads £16.4m in series-C round in Ravelin

Ravelin is a fraud detection technology company that focuses on payment fraud

Milaya in £15m round for Lanistar at £150m valuation

Established in 2019, the London-based company has 45 employees, with plans to triple its headcount

Riflebird-backed Piller Entgrattechnik acquired by SFO

SFO specialises in the takeover and further development of mechanical and plant engineering companies

Apax invests in $65m series-C for PriceFX

Apax Digital Fund closed on $1bn in December 2017 and was deployed 23% in December 2019

Hony to lose control of PizzaExpress in debt-for-equity swap – report

Many bondholders bought into the restaurant chain in late 2019 as its bonds traded lower

Sandton invests £10m in Nextbase

Sandton's investment will be used to accelerate the implementation of new technologies

Mercia invested £17.5m in 2019/20

Mercia's NVM VCTs raised ТЃ38.2m in new capital, while the BBB also allocated an additional ТЃ54.3m

LDC's makes 18 investments in H1 2020

In a half-year update, the firm announced the majority of the deals were completed since March

Kester-backed Frontier sells business to HIG-backed Vernacare

HIG invested from its Growth Buyout Equity Fund III to acquire Vernacare from Palatine

YFM backs £17m GHG buyout

Senior debt and a working capital facility are being provided by Triplepoint

Synova-backed Fairstone acquires Mantle Financial Planning

Synova committed ТЃ25m to the development of Fairstone in 2016, drawing equity from Synova III

ETF closes Environmental Technologies Fund III on £167m

Around 40 existing and new LPs, including British Patient Capital and the EIF, participated

Pictet closes Monte Rosa V on $1.164bn

Earlier funds have generated a net IRR of more than 13% and a TVPI of 1.65x