Articles by Katharine Hidalgo

Advent's £3.9bn Cobham take-private likely to go ahead

Advent made a takeover offer of 165 pence per share in cash, which represents a 34% premium in July

August Equity exits Wax Digital

This is the fund's sixth realisation, following the sale of Vet Partners and Compass Community

Foresight sells Idio for 2x return

Insight Venture Partners acquired Episerver, the acquirer, from Accel KKR in 2018

Hermes GPE closes PEC IV on $603.5m

Predecessor vehicle PEC III closed on $389m in October 2017 and is now fully deployed

Arlington acquires Doncasters' forging business

Arlington expects to put fresh capital into the business and grow it through acquisitions

MMC Ventures holds final close for Scale Up Fund on £100m

Bluetower Associates acted as placement agent and Osborne Clarke provided legal advice

Alteri to acquire Steinhoff businesses

Acquired businesses include Bensons for Beds, Harveys Furniture, Relyon and Steinhoff UK Beds

BGF exits Bar Soba

Bar Soba's management team and staff will stay on with the company following the acquisition

Eclipse leads $20m series-A for Wayve

Existing investors Compound, Firstminute and Fly Ventures all participated in the round

Atlantic Bridge leads $10m series-A for Siren

DVI Equity Partners, Frontline Ventures and Enterprise Ireland also take part

Lakestar, Dawn Capital co-lead $37m series-B for Eigen

Existing investors Temasek and Goldman Sachs Growth Equity also participate in the funding round

Inflexion-backed Radius acquires Pure Telecom

Radius first acquired a telecommunications company in October 2018 with Adam Phones

Alcuin acquires Marsden

Marsden's current managing director, Richard Black, will continue to lead the company

LDC-backed Linley & Simpson acquires Beercocks

Financing for the acquisition was provided by Santander Corporate and Commercial Banking

Connection Capital sells JCRA

Connection Capital provided ТЃ6.7m to support the buyout of the business in 2017

BC-backed Advanced acquires CareWorks

CareWorks is Advanced's first acquistion following the investment from BC Partners

Aliter acquires Sponge

Aliter acquired Bolt Learning in May 2019 and concurrently provided financing to acquire Mercurytide

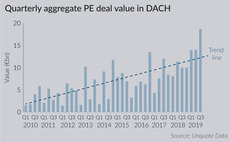

DACH activity skyrockets in Q3 despite looming recession

Aggregate value in DACH for Q3 reached its second highest level at €18.7bn

Balderton VII closes on $400m hard-cap

Balderton VII's predecessor closed on $375m and is now more than 50% deployed over 30 investments

Blackstone to buy stake in MagicLab in $3bn deal

London-based MagicLab owns social networking and dating apps Bumble, Badoo, Lumen and Chappy

Insight invests $8m in Hundred

Hundred offers a portfolio of 34 vitamins that consumers can access through a subscription model

True Venture leads $13m series-A for Wefarm

Existing investors LocalGlobe, ADV and the Norrsken Foundation also participate in the round

LDC-backed Eque2 acquires ClipIt

LDC acquired a significant minority stake in Eque2 from Livingbridge in a ТЃ16m deal in 2017

Mobeus-backed Ludlow acquires Ivan A Hargreaves

Ludlow finances its third acquisition this year with its debt facility provided by Santander