Deals

MTIP leads €11m round for Trialbee

MTIP is investing from MTIP Fund II, a vehicle that held a first close in November 2019

BPE backs Dätwyler Sealing Technologies MBO

MBO is the first investment from BPE 4, which held a final close in March 2020 on €135m

Karma, OpenOcean in €2m round for AppGyver

Company will use the fresh capital to accelerate the development of its visual app-builder platform

Omers leads €16.25m series-B for Deliverect

Omers Ventures managing partner Jambu Palaniappan will join the Deliverect board

FIEE backs Cremonesi

FIEE invests in Italian companies operating across the energy efficiency and renewable sectors

MVM invests $14m in MDxHealth

MVM is drawing equity from MVM Fund V, which held a first close on £150m in November 2018

VR Equitypartner-backed Kälte Eckert buys Gartner Keil & Co

Deal is the second add-on for the Germany-based cooling systems and cold storage specialist

Abac Capital exits Metalcaucho to trade

Sale ends a five-year holding period for the GP, which invested in the company via Abac Solutions

Insight Partners leads $25m series-C round for Templafy

Latest round brings the total amount raised by the Danish software company to around $70m

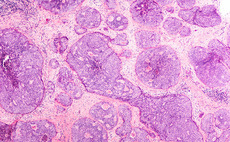

VCs in $80m series-B for Compass Pathways

Compass intends to use the funds to expand upon its lead programme in psilocybin therapy

CRV leads €15m series-A for Factorial

Previous backers Creandum, Point Nine and K Fund also take part in the investment

Felix Capital et al. back €15m series-B for YFood

Foodtech company has increased its revenues by 300% in the past year, according to a statement

Synova-backed Fairstone acquires domestic IFA firms

Synova committed ТЃ25m to the development of Fairstone in 2016, drawing equity from Synova III

IW invests £2m in GPDQ

IW Capital provides equity investments, typically of ТЃ1-2.5m, through EIS investments

LocalGlobe leads €4m round for Libeo

Funding round also sees participation from existing investor Breega and several business angels

HCS sells AGO to RheinEnergie

Sale ends a six-year holding period for HCS and was conducted via a competitive auction process

Maven leads round for Intilery

Founded in 2012 and based in Chester, Intilery offers a real-time omnichannel CRM platform

K Fund in €1m round for Frontity

Company plans to use the financing to improve its framework, roll out new features and grow its community

Nord Capital exits Stadline to trade

Sale ends a five-year holding period for Nord Capital, which controlled a minority stake in the company

FSN's Fellowmind bolts on ProActive

Add-on follows the GP's acquisition of the IT consultancy in November 2019 via FSN Capital V

Perwyn backs Hea Expertise; IDI reaps 35% IRR

Deal ends a three-year holding period for IDI, which owned a 40% stake in the company

Anders Invest buys 50% stake in Topvorm Prefab

GP sees a positive future for the residential construction sector in spite of short-term challenges

Verdane invests in Conscriptor and Max Manus

GP will merge the two companies to form a new healthcare technology group in Scandinavia

Ardian buys minority stake in Euro 4x4 Parts

Auto parts retailer also announced the bolt-on of B2B-focused market peer Japocat