Deals

Enterprise Ventures invests in Isis Forensics

Enterprise Ventures (EV) has backed UK-based forensics software developer Isis Forensics with funds from its North West Fund for Venture Capital and Lancashire County Councilтs Rosebud Fund.

Connect Ventures invests in Teleportd

Connect Ventures has invested in a $1m seed funding round for French social media marketing management company Teleportd, according to reports.

Alto makes 2x on Monviso SBO

PM & Partners Private Equity has acquired Italian food producer Monviso from Alto Partners.

Nordic Capital refinances Orc with €60m bond issue

Orc Group, a Swedish financial technology and services provider owned by Nordic Capital, has placed a five-year тЌ60m senior secured high-yield bond.

Principia backs Itsworld with €2m

Italian VC firm Principia has injected €2m into Itsworld Sicilia in exchange for a 28% stake in the firm.

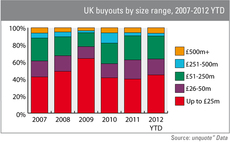

UK mid-market most affected by recession

The mid-market has suffered more during the double dip recession than other market segments, according to figures from unquoteт data.

CT Investment Partners et al. back Cable-Sense

CT Investment Partners' North West Fund for Energy & Environmental and MTI Partners' UMIP Premier Fund have backed UK-based infrastructure management company Cable-Sense with ТЃ800,000.

NTC Holdings further reduces stake in TDC

The holding jointly owned by Apax, Blackstone, KKR, Permira and Providence has sold 80 million shares in Danish telecommunications company TDC.

Silver Lake buys friedola Tech stake from WHEB

Silver Lake Partners has taken over WHEB Partners' majority stake in German recycled plastics processor friedola Tech, through its energy investment initiative Silver Lake Kraftwerk.

NiXEN's Babeau Seguin buys Vesta

NiXEN's portfolio company, French home construction group Babeau Seguin, has made its second bolt-on in less than a year with the acquisition of Vesta.

PE-backed Diana completes fourth bolt-on

French food manufacturer Diana Ingrédients, a portfolio company of AXA Private Equity and Motion Equity Partners, has acquired Givaudan’s vegetables, wines and vinegars extracts range.

Critical Ventures backs Watchful Software

Critical Ventures I Fund, in conjunction with Critical SGPS, has provided funding for Portugal-based information security technology company Watchful Software.

Gimv sells Mentum to InfoVista

Gimv has sold its stake in French software provider Mentum to network solutions company InfoVista after a 10-year holding period.

Greensphere Capital backs Greenlight

Greenlight AD Power, a holding company behind a proposed anaerobic digestion platform, has raised ТЃ16m from Greensphere Capital, the sustainable energy-focused private equity firm chaired by Jon Moulton.

DBAG acquires Heytex Bramsche from NORD Holding

Deutsche Beteiligungs AG (DBAG) has acquired Heytex Bramsche, a German manufacturer of print media and technical textiles, in an SBO from NORD Holding.

Octopus et al. invest in YPlan

Octopus Investments, Wellington Partners and angel investors have backed London-based app developer YPlan with a $1.7m seed financing round.

Mangrove backs HTGF's ezeep

Mangrove Capital Partners has backed German software start-up ezeep, a portfolio company of High-Tech Gründerfonds (HTGF).

NGN Capital et al. in $40.3m Endosense series-C round

NGN Capital and a syndicate of existing investors have backed Swiss medical technology company Endosense with $40.3m in a series-C funding round.

Iris leads €2m round in YouScribe

Iris Capital has led a €2m funding round for French online content publication platform YouScribe.

AXA PE's Arkadin acquires Novasight

Arkadin, a global collaboration services provider backed by AXA Private Equity, has acquired Novasight.

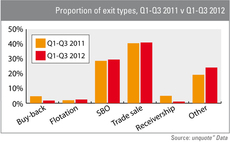

Exit routes: secondary buyouts gain popularity

Secondary buyouts have seen their share of the exit market rise, while trade sales hold steady, according to the latest figures from unquote” data.

InnoBio joins TxCell investors in third round

CDC Entreprises-managed InnoBio Fund has joined existing investors Auriga Partners and Seventure Partners in a €12.4m financing round for French biotech company TxCell.

BioGeneration and INKEF lead €4.8m round for Lanthio

BioGeneration Ventures and INKEF Capital have led a €4.8m series-A funding round for Dutch pharmaceuticals start-up Lanthio Pharma.

Impax-backed Epuron buys wind project from Gamesa

Epuron, a renewable energy project developer backed by Impax Asset Management, has acquired La Souterraine, a French wind project, from wind energy technology firm Gamesa.