Deals

Kernel backs Kinesense

Kernel Capital has invested тЌ500,000 in Dublin-based software company Kinesense.

Second deal in a week for BGF with SkyDox investment

Scottish Equity Partners (SEP) and the Business Growth Fund (BGF) have taken part in a ТЃ20m round for UK-based business software developer SkyDox.

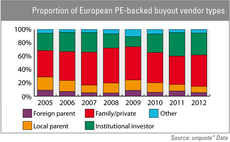

Corporate spin-offs still few and far between

Primary transactions tend to be harder to source across the board nowadays, but corporate spin-offs have proved particularly elusive since 2009: while deals sourced from a trade player accounted for nearly a fifth of European buyout dealflow that year,...

Ciclad takes majority stake in Inovelec SBO

Small- and mid-cap focused GP Ciclad has acquired French electronic equipment manufacturer Groupe Inovelec alongside the group's founders and managers.

Industrifonden backs Anyfi Networks

Industrifonden has invested SEK 9m in Swedish Wi-Fi technology developer Anyfi Networks, alongside the current owners' SEK 1m investment.

Synova backs Kinapse

Synova Capital has invested in UK-based consultancy services provider Kinapse.

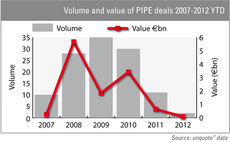

Stock markets blocking the PIPE

The number of investments by private equity funds in publicly traded shares has fallen significantly in the past two years as the stock market has detached from measures of GDP, according to figures from unquote” data.

Maven reaps 50% IRR on WEMS mezz investment

Maven Capital Partners has exited WEMS International and achieved a 50% IRR on the mezzanine loan it provided two years ago.

AXA PE and Capzanine arrange mezz for Village Center buyout

AXA Private Equity and Capzanine have arranged a €37m mezzanine facility for the buyout of French outdoor accommodation company Village Center by 21 Centrale Partners.

Intel et al. in €10m round for Sigfox

Intel Capital has joined existing investors Elaia Partners, Partech Ventures International and iXO Private Equity in a €10m funding round for French technology company Sigfox.

SAM Private Equity invests $12m in Nujira

British semiconductor business Nujira has secured a $12m financing round from SAM Private Equity.

IK takes over AXA PE's Unipex

IK Investment Partners has acquired a majority stake in French speciality chemicals business Unipex Group from AXA Private Equity.

WHEB and Hermes GPE invest £13m in WEMS

WHEB Partners and Hermes GPE have invested ТЃ13m in smart energy company Wireless Energy Management Systems International Ltd (WEMS).

Sovereign's City & County in 10th acquisition

Sovereign Capital-backed City & County Healthcare Group has acquired Conard Care Services, a Northern Irish domiciliary care provider, in its 10th bolt-on since 2009.

SV Life Sciences et al. in $7.6m series-B for Karus

Karus Therapeutics has secured a $7.6m series-B financing round, led by SV Life Sciences, New Leaf Ventures, Novo A/S and International Biotechnology Trust.

BGF's Shuropody marks GP's third Midlands deal

The Business Growth Fund (BGF) has invested ТЃ3m in Midlands-based footcare provider Shuropody.

EdRIP backs Groupe DEFI spin-off

Edmond de Rothschild Investment Partners (EdRIP) has taken a minority stake in the management buyout of French advertisement technology specialist Groupe DEFI.

Industrifonden et al. back Actiwave

Industrifonden and SEB Venture Capital have invested SEK 15m in Swedish audio technology developer Actiwave.

LPs getting to grips with the (right) secondary buyout

Secondary buyouts

Metric invests in Dutch hotel developer

Metric Capital Partners has committed €120m to Dutch hotel developer and operator TVGH.

North West Fund backs Connect Technology Group

The North West Fund for Digital & Creative has invested in Burnley-based systems developer Connect Technology Group.

TIME backs Transmedia Communications

TIME Equity Partners has invested €6m in Swiss digital media company Transmedia Communications, which operates the iConcerts brand.

Octopus injects £1.6m into LifeBook

Octopus Investments has provided UK-based autobiographies publisher LifeBook with ТЃ1.6m of early-stage funding.

Chasing the primary deal

Firsthand experience