Deals

University and college spinouts make a timid rebound

The funding of Arvia, a spinout from the University of Manchester's School of Chemical Engineering, by MTI Partners for £3.8m is the latest of nine university spinouts noted since the year started.

HTGF et al. invest in Cuciniale

High-tech Gründerfonds (HTGF) and business angels consortium BAC1 have backed start-up Cuciniale GmbH with an undisclosed sum.

BlackFin acquires Chiarezza

BlackFin Capital Partners has wholly acquired Italian insurance aggregator Chiarezza from motor insurance firm Admiral Group.

GCP-backed Killby & Gayford goes into administration

Former 3i portfolio company Killby & Gayford т currently backed by Growth Capital Partners (GCP) т has gone into administration, according to reports.

Lyceum's Access acquires DHC Finance

Lyceum Capital's portfolio company Access UK has acquired business support software provider DHC Finance Ltd.

Investindustrial reaps 3x on Ducati exit

Investindustrial has sold Italian motorcycle designer and manufacturer Ducati to Audi AG, a deal believed to be worth slightly less than €900m.

Enterprise Investors backs United Oilfield Services

Polish private equity firm Enterprise Investors (EI) has taken a minority stake in Polish oil services company United Oilfield Services for $28m.

Auriga and Omnes inject €7m into Eptica

Auriga Partners has joined existing investor Omnes Capital (formerly Crédit Agricole Private Equity) in a €7m round for French CRM software editor Eptica.

ISIS invests in Happy Days

ISIS Equity Partners has invested ТЃ3.7m in day nursery operator Happy Days.

HTGF backs KonTEM

High-Tech Gründerfonds (HTGF) has made an investment in German healthcare technology start-up KonTEM GmbH.

Advent International's GFKL sells GENEVA-ID

Advent International’s portfolio company GFKL Financial Services AG has sold its subsidiary GENEVA-ID GmbH to SUBITO AG.

Montagu acquires College of Law

Montagu Private Equity has acquired the legal education and training business of The College of Law.

YFM backs Seven Technologies

YFM Equity Partners has invested ТЃ6.6m in Northern Irish engineering firm Seven Technologies.

Lyceum's Adapt makes £13m acquisition

Lyceum Capital has invested an undisclosed sum of fresh equity to support the ТЃ13m add-on acquisition of eLINIA by its portfolio company Adapt.

MTI leads £3.8m round for Manchester Uni spinout Arvia

MTI Partners, Sustainable Technology Investors Limited, Park Walk Advisors and other investors have backed technology company Arvia Technology with ТЃ3.8m.

Assietta acquires Pamfood

Assietta Private Equity has acquired a 90% stake in Ligurian speciality food producer Pamfood from the Maggiali family.

Sofinnova Partners exits BlueKiwi

Sofinnova Partners has sold its entire stake in social networking software editor BlueKiwi to IT services firm Atos SA Group.

Sofimac et al. in €2.5m round for Jet Metal Technologies

Sofimac has joined existing investors Viveris Management, Aster Capital, Naxicap Partners and Rhône-Alpes Création in a €2.5m funding round for French surface treatment specialist Jet Metal Technologies (JMT).

HTGF at al. provide seed funding for Oncgnostics

High-Tech Gründerfonds (HTGF) has invested €500,000 in a seed round for molecular diagnostic start-up Oncgnostics GmbH.

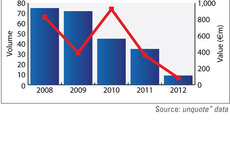

Larger UK buyouts pick up in Q1

Larger buyout activity is picking up pace once again after suffering in late 2011, according to the latest finding of the unquoteт UK Watch, in association with Corbett Keeling.

Industrifonden and SEB Venture back Clavister

Industrifonden and SEB Venture Capital have backed Swedish IT security firm Clavister with a SEK 40m investment.

OpCapita acquires GAME Iberia

OpCapita has acquired the Iberian operations of distressed videogames retailer GAME Group.

Better Capital acquires 90% of Jaeger Group

Better Capital has bought a majority stake in UK fashion house Jaeger Group for ТЃ19.5m.

Broadlake acquires Jede UK

Broadlake Capital has acquired Manchester-based coffee company Jede UK from Jede, a subsidiary of Nestle.