Funds

Southern Europe unquote" April 2010

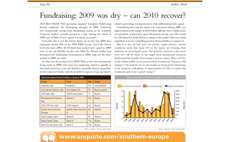

A quarter into 2010 and European private equity dealflow is still fragile, prompting many GPs to remain on the sidelines. Meanwhile, figures from the upcoming unquote” European Fundraising Review emphasise the fundraising drought of 2009.

Carlyle raises $1.1bn financial services fund

The Carlyle Group has raised $1.1bn for its first financial services fund, Carlyle Global Financial Services Partners (CGFSP).

HarbourVest to list senior secured loans fund on LSE

HarbourVest Partners has launched a new senior secured loans fund, HarbourVest Senior Loans Europe Limited, which will be admitted to the Main Market of the London Stock Exchange.

Boehringer Ingelheim launches €100m corporate venture fund

Pharmaceuticals giant Boehringer Ingelheim has launched the Boehringer Ingelheim Venture Fund, a тЌ100m corporate venture vehicle.

AXA and F2i to bid for Endesa's gas assets

It is understood that AXA Private Equity and Italian investor Fondi Italiani per le Infrastrutture (F2i) are joining forces to bid for the acquisition of utilities company Endesa gas' assets in Spain.

Platina closes renewable energy fund on €209m

Renewable energy and turnaround investor Platina Partners LLP has reached the closing of its European Renewable Energy Fund (EREF) with total commitments of тЌ209m.

bmp wins mandate for €20m early-stage fund

bmp has won the mandate to manage a €20m early-stage fund in Brandenburg following a Europe-wide tender.

3i closes growth fund on €1.2bn; open to new investments

Further strengthening its position in the markets, 3i has just announced the final close of its Growth Capital Fund on тЌ1.2bn, and has made it clear that the firm will continue to look for new investment opportunities.

Lexington Partners holds interim closing on $3bn

Secondaries specialist Lexington Partners has held an interim closing of its seventh fund, Lexington Capital Partners VII, on just over $3.1bn.

Ventizz acquires Sovello AG

Ventizz Capital Partners has acquired solar module manufacturer Sovello AG from REC Group, Evergreen and Q-Cells.

DBAG to raise €200m expansion capital fund

Deutsche Beteiligungs AG plans to raise a €200m expansion capital fund.

MMC Ventures launches EIS fund for youngsters

MMC Ventures has launched a tax-efficient EIS fund aimed at younger investors aged between 18-35 years old.

GEM Benelux holds first and final €200m close of second fund

Gilde Equity Management (GEM) Benelux has reached the first and final close of its new fund, GEM Benelux II, at its hard cap of €200m.

Atomico closes second fund on $165m

Early-stage technology investor Atomico has closed its second fund, Atomico Ventures II, on $165m.

Gimv-XL closes on €609m

European investment company Gimv has announced the final closing of its latest vehicle Gimv-XL fund at €609m.

BPE acquires Domilens

BPE Unternehmensbeteiligungen GmbH has, together with the management team, wholly acquired medical supplies company Domilens GmbH from STAAR Surgical AG, Switzerland.

Pohjola's Selected Private Equity Funds II reaches first closing on €97m

Finnish based, pan-European private equity fund of funds manager Pohjola Private Equity Funds has reached the first closing of its Selected Private Equity Funds II (SPEF II) on тЌ97m.

CBR Management GmbH acquires easy sports from the founder

CBR Management GmbH has acquired 54% of easy sports from the founder. The owner kept 40% of the shares; active co-investors hold the balance.

AFINUM Management buys Erpo International

AFINUM Management GmbH has acquired upholstery furniture maker Erpo International from its previous owner Thomas Jungjohann for an undisclosed sum.

Q&A: Fundraising Review/Preview

Francois Rowell speaks to Lorenzo Lorenzotti, managing director at fund-of-fund ACG Private Equity about fundraising in 2009 and the prospects for 2010.

Mutua Madrileña suscribes €16m to Altamar fund

Spanish insurance firm Mutua Madrileña has committed €16m to Altamar Secondary Opportunities, taking a 25% stake in the €65m secondaries fund.

Siemens hearing aids sale might be cancelled

According to reports, the sale of Siemens Audiologische Technik, the hearing aids business of Siemens AG, might not go through.

Green spark: Renewables still generating returns

Despite the difficult economic backdrop, environmental infrastructure continues to prove attractive to investors. By Francinia Protti-Alvarez

BOCE acquires Austria Email from UIAG

Buy-Out Central Europe has acquired 63.41% of listed Austria Email AG from investor UIAG.