Fundraising

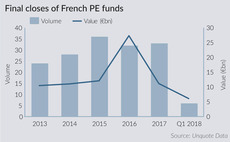

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

France Fundraising Report 2018

The first quarter of 2018 has set the tone for what is likely to be a busy year for fundraising in the region

Edmond de Rothschild Private Equity to launch six new funds

PE branch aims to raise €3bn over the next three years, to reach €5bn of AUM by late 2021

Sino-French PE relations move forward

Chinese trade buyers, GPs and LPs are increasingly active in the French market as the number of funds with Sino-French strategies increases

Metric Capital to launch €500m fund with Virgin's Branson

Fundraising for the consumer-focused vehicle is expected to officially launch in the coming months

DACH GPs consider alternative funding models

With three of the region's top five most active GPs investing from non-standard funds in 2017, some other GPs are also adopting alternative approaches

Coller leads €2.5bn secondaries deal for Nordic Capital VII

Restructuring of Nordic Capital's seventh fund is one of the largest GP-led secondary transactions inked in Europe

European Commission launches VentureEU

VentureEU is a venture capital funding programme backed by тЌ410m in fresh funding from the EU

Japanese insurance companies eye DACH funds

Insurance companies in Japan are considering increasing their exposure to European funds, with DACH GPs most likely to benefit

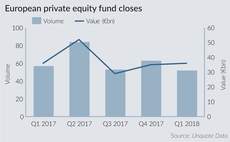

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

French VC fundraising shifts towards sector specialisation

A number of specialist VC funds have held first or final closes in recent months, bringing distinct advantages and risks in equal measure

Impact agenda: Attracting institutional capital

Global PE firms are launching impact funds tailored to appeal to institutional investors

EIF's push into private capital management

The European Investment Fund is aiming to raise up to тЌ2.1bn in private capital for a new investment platform focused on venture and growth vehicles

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

Draper Esprit invests in five seed funds

Managers include Berlin-based Join Capital and Helsinki-based Icebreaker

Mayfair raises for second fund in US and Europe

GP makes an SEC filing listing commitments of $130m from US-based institutional investors

Capzanine to hold final close for €950m private debt fund in Q1

Launched in Q1 2017, Capzanine 4 Private Debt fund should hold a final close in March

Nordic to restructure fund VII, roll €2.2bn into new vehicle

Buyers Goldman Sachs and Coller Capital are offering an 11% premium to NAV to existing LPs

Abac launches venture fund to invest in Spanish start-ups

Vehicle, created in partnership with Rubén Bonet, will invest up to €100,000 per round

Turkven to raise fourth fund in H2 2018

Fund is a follow-up to the current fund, Turkish Private Equity Fund III, which held a final close in 2012 on $840m

Less specialisation in southern Europe as generalists flourish

Trend of fund specialisation has been observed in European PE but LPs are still supporting less differentiated strategies in Southern Europe

CEE Fundraising Report 2017

An in-depth statistical analysis of recent fundraising trends in CEE, with insight from local experts, now available to download

Morgan Stanley closes $425m co-investment fund

Fund surpasses its $350m target and will invest in firms in North America and Europe

European PE in 2018: beware the bullet

unquoteт brings together a group of leading practitioners to analyse industry developments during 2017 and discuss emerging trends heading into 2018