Fundraising

SCERS commits $40m to Paine Schwartz Food Chain Fund V

Fund, launched in early 2018, has a $1.2bn target and invests in the food and agribusiness industry

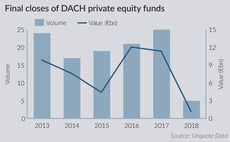

DACH funds still proliferate despite fundraising lull

Fund launches remain at near record levels in the region, as GPs look to further specialisation in order to stand out

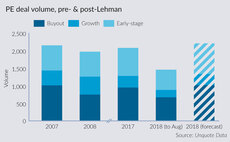

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

WSIB set to back KKR European Fund V

Following the approval, the full board will consider the recommendation on 20 September

Litorina holds final close for fifth fund

Fifth flagship fund closed on its target of SEK 3bn, an increase of 20% from its predecessor

Certior holds €51m first close for Credit Opportunities Fund II

Fund focuses on the European SME direct lending segment, in particular in seeding emerging managers

Headway invests in restructuring of Alter Capital fund

GP established a new vehicle, Alter Cap II, to purchase the fund’s portfolio and provide capital

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

CEE dealflow drops in H1 as exits soar

Buyout activity in the first six months of 2018 was at the lowest H1 level seen since 2009

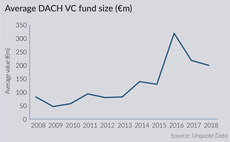

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

Q&A: Alto Partners' Raffaele de Courten

Unquote speaks to the firm's founding partner about fundraising, dealflow and debt facilities in the Italian market

Allocate 2018: Risk-return for maiden managers and spin-outs

First-time vehicles have enjoyed historically good fundraising conditions over the last two years

Draper Esprit to co-invest with Earlybird

Draper Esprit has taken a stake in Earlybird's new Digital West Early Stage Fund VI

INVL launches Baltic Sea Growth Fund

Fund will focus on acquiring minority stakes and will take an active role in management

Italian funds find new source of capital

Local private pension funds are hiking their allocations to Italian private equity, improving fundraising prospects in the mid-market space

Cairngorm aiming for third fundraise in 2019

UK-based investor is likely to begin fundraising in the new year, with Cairgorm Capital II being currently depoyed

DACH Fundraising Report 2018

Private equity fundraising in the DACH region continued to build on strong momentum in 2017

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017

Q&A: Nordic Capital's Kristoffer Melinder

Partner Melinder discusses Nordic fundraising, the increasing focus on ESG, and differentiated strategies in high-price environments

Video: Mandarin's Inna Gehrt on DACH opportunities

Inna Gehrt, partner and head of DACH at Mandarin, explores why the region is viewed as an LP magnet

Dutch VC activity reaches all-time high

Biotech and pharma are driving record levels of VC investment in the Netherlands, while venture fundraising continues to perform strongly

Korea Post allocates $200m to global buyout funds

Korea Post Insurance plans to allocate $200m to as many as three managers focusing on global buyouts, predominantly in North America and Europe.

Draper Esprit to raise £115m via share placement

VC has raised ТЃ61m across its EIS, VCT and secondary funds, giving it an additional total of ТЃ176m