GPs

GP Profile: Greenpeak Partners on emerging manager fundraising and specialisation

Buy-and-build specialist looks for portfolio add-ons as it contemplates hitting the road for a new fund in 2023

Summa opens North American office

Three existing partners will lead the California office, which is the GPтs first beyond Europe

Carlyle CEO Kewsong Lee steps down after two years

Executive led the US GP into other alternative assets like credit; no immediate successor announced

Pinova expects final close for Fund 3 before year-end

DACH industrial technology and IT investor has set a EUR 250m target for the vehicle

Montagu to exit Arkopharma for EUR 450m

Sale of French supplement maker leaves two unrealised assets in 2010-vintage Montagu IV

SwanCap plans October first close for Fund VI

German GP has a EUR 350m target for co-investment vehicle, which will follow the strategy of 2019-vintage predecessor

Eurazeo's NAV dips amid volatile markets

Net asset value dips by 3.9% as French sponsor creates contingency buffer of EUR 500m to account for market uncertainty

GP Profile: MCP steps up DACH and international focus ahead of next fundraise

ESG and continued expansion of its international LP base also on the agenda, managing partner Inna Gehrt tells Unquote

Bridgepoint Europe VII in final stretch of EUR 7bn fundraise

GP’s latest flagship fund held a EUR 4bn close in mid-May, with a final close expected in H1 2023

SHS nears EUR 250m hard cap on sixth fund

Healthcare fund’s EUR 200m target exceeded in first close with commitments from around 60 LPs

FPE Capital bolsters investment team

Ben Cole promoted to investment director at the software and services growth investor

Pemberton strengthens team with four senior hires

Anders Svenningsen, Christoph Polomsky, James Taylor and Sally Tankard join the firmтs European offices

VC Profile: Vektor Partners backs tech mobility transformation with new fund

VCтs debut fund has a EUR 175m hard-cap and aims to back startups with initial tickets of EUR 3m-EUR 5m

Nest mandates HarbourVest for PE investing

Workplace pension scheme has made its second PE mandate following its partnership with Schroders

BGF announces changes in leadership

CIO Andy Gregory to head UK growth investor as Stephen Welton is made non-executive chair

Astorg, Epiris to split Euromoney in two in GBP 1.6bn agreed offer

The deal will see Astorg carve out the Fastmarkets commodity pricing brand, with the remaining business controlled by Epiris funds

Waterland names van Cauwenberghe as next group managing partner

Cedric Van Cauwenberghe will succeed Frank Vlayen in 2023 and will head the GP's day-to-day running

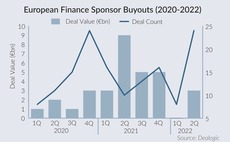

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

Keyhaven bolsters team with six promotions

Secondaries specialist's promotion include Sarah Brereton's advancement to partner

The Bolt-Ons Digest – 13 July 2022

Unquote’s selection of the latest add-ons with Ardian's Aire, Kester's Rephine, Arta/KKR's Alvic, Capiton's Dec Group, and more

CapMan exits Fortaco, buys Netox

Sale marks final exit from sponsor's eighth buyout fund; Netox deal is sixth investment via eleventh

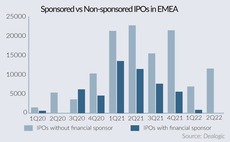

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Adagia in exclusivity to buy Motion Equity's Minlay

GP beats out Apax, Naxicap in auction final round; deal marks second transaction from its debut fund