GPs

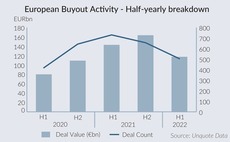

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Waterland invests in tax and audit advisor Cooper Parry

GP is deploying capital from Fund VII, where many other business support services companies sit

Levine Leichtman Capital appoints head of Europe

Promotion of Josh Kaufman comes as GP looks to grow its nascent German investment capabilities

Inflexion promotes two new partners

GP makes series of promotions and appointments following GBP 2.5bn fundraising earlier this year

Earlybird names three new Digital West partners

Andre Retterath and Paul Klemm are existing team members, while Vincenzo Narciso joins from Px3 Partners

Acton Capital holds Fund VI first close, expands investment team

VC firm has hired Sophie Ahrens-Gruber in Munich and appointed Hannes Gruber as partner in Vancouver

Women lead push for diversity in PE, M&A

Supporting diverse hires and leadership, as well as opening up networks, remain key

VC Profile: Octopus backs pre-seed ecocystem with fresh fund

Fund is headed by Kirsten Connell and Maria Rotilu and has extended its hard cap to GBP 15m following a first close

Riverside appoints Höppner as chief sustainability officer

Dörte Höppner joined the GP in 2017 and will be responsible for its ESG initiatives globally

Palatine hires investment director from Mobeus Equity

Danielle Garland joins the mid-market sponsor's London buyout team

Record number of LPs to cut "new money" commitments – Rede Partners

Biannual LP sentiment survey also reveals that LPs are expecting a drop in distributions

Beech Tree nets 5.3x return on BCN sale to ECI

Buyer ECI nears full deployment on latest buyout vehicle ECI 11

Kester nets 8x on Avania exit to Astorg

Medical device CRO is Astorg's first healthcare deal from its EUR 1.3bn Mid-Cap fund

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

The Bolts-Ons Digest – 17 June 2022

Unquote’s selection of the latest add-ons with Holland's AMP, Triton's Kinios, Nordic's Sortera, Vitruvian's Sykes, and more

LDC hires ESG director from Deloitte

Alex Bexon will help the firm pursue sustainability commitments, such as net-zero operations, by 2030

Capcellence-backed Argo-Hytos to be sold to Voith

Trade sale follows Lincoln-led auction for Swiss hydraulic components supplier; Capcellence remains invested

Nexxus Iberia nets 4.2x on Bienzobas exit to trade

Sale of oncology group marks GP's second exit from debut fund; buyer Atrys pays 8.5x EBITDA

Gimv launches life sciences investment platform

Sponsor seeks to double portfolio and invest bigger tickets in drug development companies

Hg exits Medifox Dan to trade for EUR 950m, nets 4x return

Houlihan-Lokey led auction attracted large-cap sponsors such as BC Partners, Warburg Pincus and Permira

HIG Bayside promotes Malezieux to managing director

Mathilde Malezieux has more than 16 years of investment banking and distressed investment experience

GP Profile: Kyip Capital on debut fundraising, opportunities in Italian education

After interim close, Milan-based fund seeks up to EUR 165m by early 2023; eyes deals to grow data validation business and university platform

Family offices raise stakes in private equity – UBS

High inflation, rising interest rates leading wealthy families to review investment options, says report

LPs' net returns highest since financial crisis – Coller Capital

Secondaries specialistтs Summer 2022 Barometer shows that half of LPs want to increase their allocation to alternatives, with 91% still committing to PE first closes with incentives