Investments

Deal in Focus: Wise backs Tapì's SBO

Italy-based bottle cap producer will adapt its expansion strategy to account for geopolitical developments in Central and North America

Modern TMT managers challenge traditional skin-in-the-game incentives

Private equity investors face a challenge to hold onto business managers for a 3-5 year holding period

Deal in Focus: Cobalt makes 3.5x on TCS sale to Meeschaert

Vendor extended its holding period with LPs' blessing in order to fully implement its buy-and-build growth strategy

Deal in Focus: Hannover Finanz backs PWK's MBO

An in-depth look at the GP’s acquisition of the German auto parts producer market

Deal in Focus: Advent, Bain buy German payment service Concardis

After Worldpay, Nets and ICBI, the Concardis deal marks the fourth acquisition in Europe for the private equity duo

Deal in Focus: Chequers exits Provalliance group

Hair salon business Provalliance generates €1.2bn in revenues serving 35 million customers per year

Packaging sector poised to secure status as PE pillar stone

Resilient nature of the sector and plentiful supply of consolidation opportunities could lead to a resurgence in activity

Deal in Focus: Astorg sells Kerneos to Imerys for €880m

Sale of the specialised chemicals company follows a three-year holding period in which the group invested in new ventures and made bolt-ons

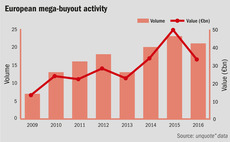

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

Political and economic uncertainty drives PE to UK staycations

Private equity players are increasingly looking to cash in on the shift in Britons' holiday habits

Deal in Focus: Ardian buys Equistone's Unither for €675m

Deal for French pharmaceuticals company will see the buisness enter its fourth consecutive period under PE ownership

UK dealflow suffers sharp drop post-Brexit

Aggregate value across the market is down by more than half year-on-year between July and November

Deal in Focus: Omnes reaps 5x in Nomios exit to Infradata

GP oversaw a doubling of the IT company's revenues during its three-year holding period, leading it to make an exit ahead of schedule

Deal in Focus: IK buys Schock from HQ Equita

Despite entering into its third period of PE stewardship, the sink manufacturer's new owner is planning to double turnover during its tenure

French GPs optimistic over looming elections

Upcoming elections could bring to power the most "business-friendly" government to date, say unquote" France Forum delegates

Q3 Barometer: Core mid-market buyouts return to growth

Mid-market deal volume across Europe reached its highest total in five quarters

Post-Brexit UK could see increased PE activity

Research finds investors are more positive about the prospects for UK dealflow over EU activity

Deal in Focus: Equistone exits Hornschuch

Sale to Continental's subsidiary followed an eight-year holding period in which the company bolted on a number of competitors

Deal in Focus: Cinven sells Avio to Space2

GP divests Italian aerospace operator to trade buyer following decade-long tenure

Deal in Focus: Qualium and CDC IC acquire Vulcanic

Pass-the-parcel deal marks the fourth consecutive period for the French cooling systems group under private equity ownership

CVC and Summit's Avast in $1.3bn deal for TA's AVG

Bolt-on is first major acquisition for Avast since being bought by CVC in 2014

Online food-ordering services feeding Benelux's IPO surge

GPs and VCs are capitalising on the improved climate for the public market exit route

Nordic GPs look to new verticals in private healthcare

GPs in the region are increasingly turning to new healthcare subsectors as the private care segment evolves into a large-cap game

French PE: dealing with rising transaction costs and valuations

Extensive due diligence and increased valuations reflect the country's increasingly complex and competitive deal-making environment