Industry

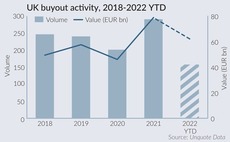

Down but not out: UK PE market confident in spite of sterling, macro concerns

Sponsors prepare to weather the storm and seize opportunities emerging from the crisis

Cathay reinforces PE team with a 14th partner for Paris office

French investment firm with USD 5bn AUM has appointed former Somfy VP Jean-Marc Prunet as partner

British Private Equity Awards 2022: winners announced

Congratulations to the winners of this year's British Private Equity Awards, announced last night in London

Capvis bets on LP pivot to 'traditional' sectors from venture, growth strategies

GP is in pre-marketing for sixth fund targeting around EUR 1.2bn, according to a source

Squire Patton Boggs bolsters German PE team with Linklaters hire

New partner Sascha Konwalski joins Frankfurt office; US law firm to open new offices in Europe

Novalpina fund exits Laboratoire XO to Stanley Capital

French drug maker is the first divestment from liquidated fund Novalpina I, now managed by Berkeley Research Group

GP Profile: Verdane looks to step up portfolio deal deployment

Technology investor plans to keep up the pace of its existing direct investments but expects to see more portfolio sellers

AnaCap carves out credit division

New business, Veld Capital, will raise new funds and also deploy via AnaCap's existing credit funds

Vendis 'very much in business' with fourth consumer fund in play

Belgian GP expects ‘disruptive scaleup’ consumer investments to weather economic downturn

Junction Growth seeks EUR 100m for energy transition fund

Belgian VC held first close for debut vehicle on EUR 75m with commitments from PMV, EIF

Verium moves Toradex, Mobil in Time into continuation fund

Verium I SCS, which closed on CHF 120m, is the family office's first LP-backed fund

Astorg gears up for EUR 6.5bn close for Fund VIII next year

French sponsor seeing “good level” of re-ups; tapping retail investors and HNWI money

DPE raises EUR 708m continuation fund for two IT consultancies

German GP’s new vehicle backed by AlpInvest, HarbourVest Partners and Pantheon Ventures

Apposite closes third healthcare fund on GBP 200m

Specialist GP’s Article 8 vehicle tracks six proprietary health impact objectives for investments

MCF Corporate Finance buys Cubus in debt advisory expansion

Deal with Frankfurt-based firm follows demand for combined M&A and financing services

Secondaries Preview: Strong LP stakes dealflow, strategy specialisation to come in 2023

With some managers overexposed to single-asset GP-led deals, secondaries GPs are taking stock of opportunities for next year

Onex Partners aims for USD 8bn target with sixth flagship fund

New generation fund to remain similar in size to the USD 7bn fifth fund, with operational improvement a key focus

Kharis, Verlinvest lead USD 80m round for Not So Dark

Series B takes French food-tech delivery startup’s total funding to USD 105m

Private equity players warn of fundraising "shake-out"

Attendees at IPEM 2022 are bracing for challenging fundraising market to continue into 2023

Adams Street launches private credit platform in Europe

Investor hires James Charalambides from Sixth Street to lead new strategy out of London

Triago expands primary directs strategy to Europe

Adviser plans to build on existing US practice, supporting sponsors raising primary capital deal-by-deal

Wingman Ventures eyes new USD 120m fund to back Swiss startups

With a larger target than its predecessor, Fund II could see more institutional investors in its LP base

Speedinvest set for Climate & Industry fund close after H1 slowdown

Aimed at supporting the GP’s own portfolio, EUR 80m vehicle has been close to 30% deployed

DCP set for final close on EUR 45m growth fund this month

Turkish VC’s second fund received commitments from 10 LPs including anchor investor EIF