Industry

Insight Partners leads USD 94m Series C for Enable

Oversubscribed fundraise brings rebate management platformтs total funding to USD 156m

PAI hires Odaro as head of ESG and sustainability

Denise Odaro joins from her role as head of IR and sustainable finance at the World Bank's IFC

Unquote Private Equity Podcast: Spotlight on GP-led secondaries

Travers Smith's Ed Ford and Sacha Gofton-Salmond share insights on structuring continuation fund deals and navigating an increasingly competitive environment

Q&A: BVCA's VC committee chair on the current outlook for venture capital

Andrew Williamson discusses the UK VC market and investing in the current macroeconomic environment

Argos Wityu puts skin in the game for new climate fund

New ‘several hundred million Euros’ vehicle pegs team’s carry to CO2 reduction targets

Financial Services Capital hires Kieren in IR team

Geraldine Kieren joins the sector-focused sponsor from Aksiaтs private markets team

Fidelity markets EUR 1bn-plus debut direct lending fund

Asset manager is in discussions with prospective LPs for vehicle registered in December

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Lightrock to tap net-zero scale-ups with EUR 860m climate fund

With LGT as anchor investor, London-based VC’s new vehicle exceeded EUR 600m hard cap

Qualium bets on high dry powder level to sustain exit valuations

Mid-cap sponsor nears EUR 500m Fund III target with closing expected before year-end, source says

Tilia Impact on the market for EUR 32m early-stage fund

Czech VC eyes institutionals and HNWIs for impact-driven vehicle; first close expected by March

Alantra-backed 33N aims for Q1 close for EUR 150m cybersecurity fund

Debut manager will deploy tickets of EUR 10m across 14 venture capital investments

Unigrains launches Italian unit with EUR 80m-100m investment plan

Milan-based operation will target agri-food businesses as sister fund FAI nears conclusion

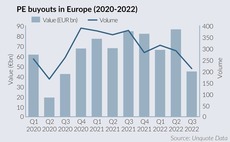

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

Volpi kicks off fund III deployment with Xalient buyout

Tech GP says specialist focus gave edge in competitive sale; will grow cybersecurity group with M&A

Fasanara targets USD 110m first close for new fund by year-end

UK-based investor in talks with institutional investors to close USD 350m VC vehicle in H1 2023

Inflexion hires talent director from British International Investment

Freddy West will work with portfolio companies to accelerate businesses via human capital strategies

BVCA Summit: PEs take long-term view to ride out uncertainty

Unquote reports on discussions around ESG, continuation funds and PE democratisation at last week’s event

Financière Arbevel gears up for new life sciences fund first close

With EUR 100m target second vehicle seeks to attract regional entities of French banks

Eurazeo expects longer fundraising for flagship Fund V

EUR 3bn target to be partly funded by balance sheet; selective, resilient investments to attract LP's interest

Agilitas bolsters team with two new hires in London

Philip Krinks, Arnaud Moreels join pan-European sponsorтs ESG and investment teams

Nordic Capital nears EUR 9bn final close for Fund XI

Expected to be 50% larger than its predecessor, new vehicle took six months to raise

BVCA Summit: "smart and ethical decisions" needed from PE, minister says

Economic Secretary Richard Fuller spoke about the industryтs role in the governmentтs growth plan

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way