Industry

HarbourVest NAV registers slight drop in July

HarbourVest Global Private Equity has announced an estimated net asset value (NAV) of $935.4m at 31 July 2012.

PE allocation boosts Oxford University returns

Oxford Universityтs Endowment Fund (OEF) says strong private equity fund performance helped it outperform its benchmark.

Can celebrities make it in private equity?

Celebrities in PE

Latvian Guarantee Agency seeks managers for local VC funds

State-backed Latvian Guarantee Agency (LGA) has launched a tender to select up to three managers for recently established VC funds.

PE rakes in record €45bn management fees

The global private equity industry is now thought to be managing some $3trn in assets. An impressive figure, but can the industry continue to grow in assets under management and sustain itself or is it now doomed to a slow decline?

Arle completes Stork refinancing

Arle has completed the refinancing of two of its portfolio companies, despite having to pull a high-yield bond issue last month.

Doughty Hanson secures £205m debt package for ASCO

Doughty Hanson has leveraged oil and gas portfolio company ASCO with a £205m senior debt package.

United against private equity

PE's public image

3i debt management business expands to the US

3i has established a debt management platform in the US through a partnership with WCAS Fraser Sullivan Investment Management.

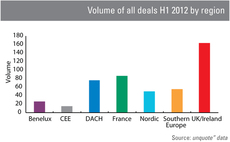

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

Patience pays off on Ziggo IPO

The unusual IPO story of Ziggo has presented yet another boost to its private equity backers as overwhelming investor demand accelerated yesterday’s share offering from a planned 18 million to 29 million ordinary shares - trading at a premium of 34%....

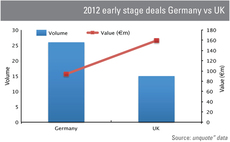

Early-stage investments: German deal volume booms

While German early-stage activity has risen in volume in the first half of 2012, the UK holds its own with strong overall deal value.

PE-backed SMEs show increased employee numbers

Staff count at PE-backed companies has increased by an average of 26% since 2000, recent research by asset manager Adveq shows.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

Entrepreneurs favour banks over PE for funding

Less than a quarter of entrepreneurs expect to turn to venture capital and private equity firms for funding over the next 12 months, according to research by Investec.

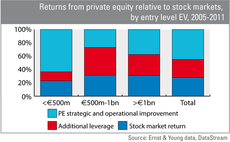

Mid-market leads value creation

Mid-market leads value creation

Moody's cuts German credit outlook

Moody's has indicated it may downgrade Germany's Aaa credit rating, which could make financing operations in Germany more difficult.

AIFMD having little impact on fund marketing

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

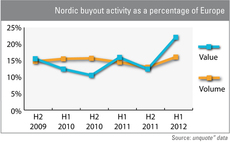

Nordics' role in European PE strengthens in H2 2011

The Nordics saw a strong first half of 2012, driven by a few large deals, pushing aggregate value from €3.4bn in H2 2011 to €5bn, showing the region's resilience to the eurozone crisis and its economic strength.

Blackstone not to replace head of European PE

Blackstone will not seek a replacement for Joe Baratta in the company's London office, according to reports.

Former Metro boss launches PE house in Germany

Former Riverside partners Kai Köppen and Volker Schmidt have partnered with ex Metro boss Eckhard Cordes and former Apax partner Christian Näther to form a new buyout house in Munich, local reports suggest.

Crédit Suisse to divest PE businesses

Crédit Suisse has announced it will sell off a number of illiquid private equity businesses within its asset management division.

Stork high-yield refinancing postponed

Stork Technical Services, backed by Arle Capital Partners, has suspended its €315m high-yield bond issue, citing tough market conditions.