Industry

General Atlantic opens new Munich office

General Atlantic has moved its German operations from Düsseldorf to Munich.

French capital gains tax reform spells trouble for PE

The French government is pushing forward with an in-depth tax reform, as announced by new President François Hollande during the Spring election, which will see capital gains taxed at the same rate as income tax – a move likely to worry local fund managers....

Distributions to LPs exceed calls in H1

Distributions to LPs have exceeded new calls in the first half of 2012, according to research from Triago.

Top 5 final closes of 2012 so far

Fundraising

Bregal reshuffles leadership

Family office Bregal Investments has appointed Steven Black and Quentin Van Doosselaere as new co-CEOs, effective from 1 January 2013.

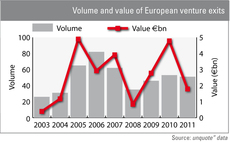

Successful exits bring venture back into the game

Venture is bouncing back since its 2008 trough, and now sees over 50 exits per year in Europe. These exits are not just about quantity, but also quality, with some of Europe's best-loved VCs sharing the limelight with lesser known players.

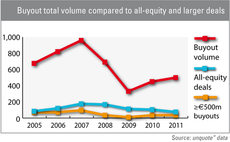

LPs getting to grips with the (right) secondary buyout

Secondary buyouts

Cathay Capital wins €150m Franco-Chinese mandate

French state-backed Caisse des Dépots et Consignations and the China Development Bank have co-funded a €150m investment fund to be managed by Franco-Chinese GP Cathay Capital.

Telefónica launches €300m network of VC funds

Telefónica Digital Venture Capital, the venture subsidiary of Spanish telecommunications firm Telefónica, has launched a €300m network of venture capital funds named Amérigo.

Three out of four GPs create jobs

Job creation

Access to growth finance a key concern for UK businesses, ECI survey shows

ECI Partners' 2012 Growth Survey of UK SMEs reveals the business climate is still impacted by the UK's dependency on European trade and the difficulty in securing finance.

LDC pumps £20m into restaurant fund

UK-based GP LDC has invested ТЃ20m in Hill Capital Partners LLP's new restaurants-focused vehicle.

Corbett Keeling moves offices

Corporate finance adviser Corbett Keeling has moved its offices.

Candover NAV per share drops 10%

Listed private equity firm Candover Investments has announced a NAV per share of 642p at 30 June, down 10% from 717p at the end of December 2011.

CEE fundraising up 50% to €1bn

Almost €1bn was raised by CEE-focused funds in 2011, up almost 50% from the previous year, according to EVCA.

The new dotcom bubble

The new dotcom bubble

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards

Healthcare investments wane after strong Q2

Investment in the healthcare industry is facing tough times as total deal value falls to its lowest level in 18 months.

Would the real CEE please stand up?

Confusion over CEE stats

Leveraged finance "at tipping point"

Royal Bank of Scotland, Lloyds TSB, Barclays, HSBC т all names that can be seen on high streets across Britain. From credit cards to mortgages to investment banking and acquisition finance, these powerful institutions once had the UKтs credit market tied...

AXA PE kicks it up a gear in 2012

AXA Private Equity (AXA PE) may have mainly attracted attention last year with the start of its spin-off from French insurer AXA, but the firm is letting its deal teams do the talking in 2012. Greg Gille reports

PE firms lose Fondiaria to Italian inner circle

PE firms lose Fondiaria

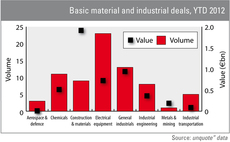

Ahlsell deal boosts construction sector value total

The construction & materials sector has seen €1.9bn worth of private equity deals being completed since January, exceeding the overall amounts invested in other industrial sub-sectors.

Top 5 buyouts of 2012 so far

Top 5 buyouts