Industry

Warburg Pincus poaches former Evercore MD to co-head Europe

Andrew Sibbald succeeds Adarsh Sarmam, who will remain a managing director and partner

Unquote British Private Equity Awards 2023: one week left to enter

Submit your entry for the 2023 Unquote British Private Equity Awards before 7th August 2023 at 4pm

AnaCap in advanced talks for two deals; has 'exciting' financial services and tech pipeline

Financial services-focused sponsor is honing in on one majority and one minority stake deal

Capvis partner to join Bregal as head of Switzerland

Simon Lussi joined Swiss GP Capvis in 2015 and had been a partner since April 2021

Turkven exits MNG Kargo, expects partial exit from Mikro Yazilim

Turkish GP sold its majority stake in Turkish parcel delivery business and could make a second exit to PE-backed TeamSystem

Eurazeo co-CEOs seek to reassure market following key departures

Listed GP is also considering options for its stake in Spanish PE platform MCH, it said in its latest results

Active Capital in EUR 150m fundraise; SIF strategy and portfolio companies eye buys

Industrials-focused sponsor expects reshoring trend to generate uptick in opportunities

Bridgepoint extends Europe VII fundraising timeline to tap 2024 allocations

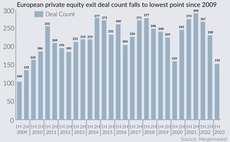

GP has raised EUR 6bn against its EUR 7bn target but has seen a 67% year-on-year drop in investment income due to fall in exits

Unquote British Private Equity Awards 2023: two weeks left to enter

Submit your entry for the 2023 Unquote British Private Equity Awards before 7th August 2023 at 4pm

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Women in PE: Earth Capital's Bezuidenhoudt and Hockley on 2024 fund launch progress and co-investment pipeline

UK-based impact investorтs female leaders discuss deployment plans and the advantages of its syndicate co-investment strategy

It's a new generation: Emerging PE professionals are propelling their careers with ESG – PE Forum Italy

Bridging generational gaps and forging ESG agendas can allow young practitioners to make their mark

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Partner Monika Nachyla outlines the CEE-based GP's fundraising and portfolio development plans

Ayre Group's VC arm eyes 10-15 blockchain deals this year

Family office-backed firm plans to invest at seed and Series A with tickets of USD 2m-USD 3m

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Betting on secular trebds and corporate partnerships, GPs are finding ways to deploy in a challenging market

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

GP Profile: NB Renaissance outlines acquisition and exit plans in final stretch of current fund deployment

Nearing full deployment for its third fund, Italian private equity firm is prepping one more deal and at least one exit by year-end

Dutch sponsor Egeria gears up for new fund launch next year

GP’s 2017-vintage, EUR 800m current fund is expected to be fully deployed within 12-18 months

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

Palatine reaps 6x money on SBO of Anthesis to Carlyle

GP will be reinvesting in UK-headquartered sustainability firm, acquiring a minority stake