Industry

Tikehau sets sights on €35bn AUM, plans to launch new funds

GP intends to launch a direct lending fund, a private debt secondary fund and a private debt impact fund

BIP, Luxempart-backed Arwe in self-administration

Automotive services company cited uncertainty of future revenues caused by the coronavirus outbreak

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

Coronavirus and private equity

All our latest coverage on the ongoing coronavirus crisis, and its impact on the European PE industry

UK industry welcomes rescue package, but concerns remain

Package includes ТЃ330bn in loans, ТЃ20bn in other aid and a postponement of business rates

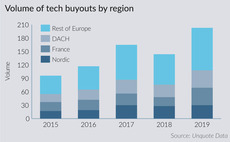

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors

Dentons appoints Orrick's Kessler as partner

Kessler specialises in public and private mergers and acquisitions, private equity and restructuring

Sanne sells private client business to JTC for up to £12m

Proceeds from the sale will be used to reduce the firm's debt and will have a small impact on earnings

Coronavirus outbreak leaves Italian PE industry in limbo

With Italy being the worst-affected European country, deals and fundraising are so far confined to a timeless limbo

AKD appoints Leroy and Nesch as partners

Appointments of Leroy and Nesch bring the total number of partners at AKD's Luxembourg office to seven

Secondaries sea change: Backing your winners

What was once the preserve of the underperformer is now shifting towards the prized asset

KKR, Henkel in final bid for Coty nail and hair – report

Advent and a consortium of Cinven and the Abu Dhabi Investment Authority reportedly left the process

FundRock launches French arm dedicated to PE, real estate

Based in Paris, the new entity is an alternative investment fund manager

GP Profile: Crédit Mutuel Equity

Board member Christophe Tournier talks through the firm's minority focus, and the upcoming launch of an infra strategy

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Podcast: In conversation with... Matthew Hardcastle, DealCloud

Hardcastle stops by to discuss his move from Inflexion to the world of tech, how GPs can unify internal processes to unlock value, and more

Private equity seeks solutions to uncertainty as coronavirus derails buyouts

Dealmakers are trying to keep the buyout show on the road as the coronavirus crisis overtakes the European market

Alvarez & Marsal appoints González as managing director

González will lead the firm's private equity performance improvement team in Spain

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

Failed auctions accelerate as sellers' market peaks – research

UK accounts for 54% of failed auctions since 2015, according to the Investec research

Eurazeo signs France Invest gender diversity charter

GP also plans to appoint women to 50% of its junior investment team roles