Benelux

Sniper Investments et al. back Ngdata

Sniper Investments, Plug and Play Ventures, ING and a number of US business angels have invested $2.5m in Belgium tech company Ngdata.

Gilde acquires Pre Pain & Smithuis from Neon Private Equity

Gilde Equity Management has acquired Dutch bakery Pre Pain & Smithuis from Neon Private Equity.

3i-backed Azelis in €30m capital increase

3i has taken part in a €30m capital increase for its portfolio company Azelis, a Belgian speciality chemicals distributor.

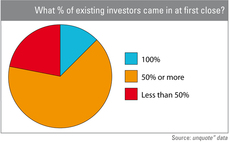

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

Teaching firms how to grow

Education is playing an increasingly pivotal role in a GP's strategy to drive the growth of its portfolio companies. Amy King investigates

Benelux unquote" September 2012

At the end of 2011, key players in the Dutch and Belgian private equity markets had mixed views about the market and how it would develop in the eye of the eurozone crisis and looming regulatory constraints.

Gimv reshapes strategy to boost future growth

Belgian GP Gimv has announced an overhaul of its strategic orientation and management team, in order to strengthen its position in the industry.

Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.

Video: Pinebridge's Rhonda Ryan

LP video interview

Advent to take Mediq private for €775m

Advent International has announced plans to delist Dutch pharma company Mediq from the Euronext Amsterdam, valuing the company at €775m.

Carlyle will not ask investors to extend $13.7bn fund

Carlyle Group will not ask investors to extend the investment period for its $13.7bn buyout fund, according to reports.

Egeria invests in Hitec Power Protection

Egeria has acquired Dutch power supply systems provider Hitec Power Protection, according to reports.

European VC "stronger now than in 2000"

Venture capital is on an upward trajectory, with phenomenal exits and a handful of fund closes building momentum. Kimberly Romaine interviews John Holloway, director at European Investment Fund, Europe's largest venture backer, about the industry's decade...

Dutch government backs new tech fund-of-funds

The Dutch ministry of economic affairs has confirmed the launch of a €150m fund-of-funds to support the country's technology companies.

New look for unquote" digital editions

unquoteт digital editions have received a major upgrade, providing new features to make using our digital magazines easier than ever. Hereтs a quick guide to getting the most out of them.

HIG combines US and European metallised paper firms

HIG Capital has acquired Belgium-based ARMetallizing (ARM) and US-based Vacumet Paper from their corporate parents, and will merge the businesses following the transaction.

Lessons from Silicon Wadi

Lessons from Silicon Wadi

Benelux unquote" July/August 2012

Luxembourg is Europe’s onshore tax haven. Like Ireland, the small country offers a whole array of tax exemptions, including duties charged on capital gains, dividends and VAT.

Metric invests in Dutch hotel developer

Metric Capital Partners has committed €120m to Dutch hotel developer and operator TVGH.

Patron hits €880m for fourth fund

Patron Capital Partners has reached a final close on its fourth fund at тЌ880m.

Foreign GPs boost Nordic buyout figures

Two months into the second half of 2012 and buyout statistics for the Nordics send out mixed signals.

Top 5 exits of 2012 so far

Top 5 exits of 2012

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards