Benelux

3i closes growth fund on €1.2bn; open to new investments

Further strengthening its position in the markets, 3i has just announced the final close of its Growth Capital Fund on тЌ1.2bn, and has made it clear that the firm will continue to look for new investment opportunities.

Debt markets go full circle

With senior leverage loans on the secondary debt market trading at around par, investors are returning to the primary market. Emanuel Eftimiu reports

Lexington Partners holds interim closing on $3bn

Secondaries specialist Lexington Partners has held an interim closing of its seventh fund, Lexington Capital Partners VII, on just over $3.1bn.

ICG Recovery Fund set to close

As the first quarter of the year comes to a close, recovery remains at the top of many businessesт agendas as more of them struggle to repay their loans. Firms like ICG are looking to take advantage of these situations with its new Recovery vehicle. Deborah...

Apollo to offer $50m worth of shares in IPO

Apollo Management is considering offering up to $50m worth of shares in an IPO on the New York Stock Exchange, according to a regulatory filing revealed yesterday.

KRS appoints Arcano to manage European PE investments

US limited partner The Kentucky Retirement System (KRS) has mandated Spanish asset management firm Arcano Capital with its European and Latin American private equity investments.

GEM Benelux holds first and final €200m close of second fund

Gilde Equity Management (GEM) Benelux has reached the first and final close of its new fund, GEM Benelux II, at its hard cap of €200m.

Carlyle and EDF launch green analysis tool

The Carlyle Group and Environmental Defence Fund (EDF) has launched EcoValuScreen, a green analysis tool to be used in the due diligence processes before making an investment.

Atomico closes second fund on $165m

Early-stage technology investor Atomico has closed its second fund, Atomico Ventures II, on $165m.

Novitas hires Vareika; opens Luxembourg office

Corporate finance advisory firm Novitas Partners has hired Michale Vareika to head up its new Luxembourg office.

Taking stock of asset-based lending

ABFA's latest stats show a decrease in asset-based lending last year. But there are promising signs that the demand for this product could rise in 2010. Deborah Sterescu reports.

French PE subsidiaries change hands

Consolidation in the French private equity market continues at pace: Natixis is closing in on a deal with Axa Private Equity over the sale of a part of its private equity division, while the IDI Group has acquired AGF Private Equity from Allianz France....

CalSTRS appoints director of private equity

CalSTRS, the California State Teachers' Retirement System, has named Margot Wirth as director of its $16.8bn private equity portfolio.

EVCA survey points to AIFM danger

While many had been nervously anticipating the decision on the AIFM directive today, it seems that everyone will have to wait a little longer, as the topic was taken off the agenda at the EU finance ministers' meeting, in what is seemingly a positive...

Adveq hires Hricko and de Vaivre

Global fund-of-funds Adveq has appointed Tomas Hricko as head of its new product management and development team, and Alexandre de Vaivre as executive director and head of Adveq's European client relations.

Gimv-XL closes on €609m

European investment company Gimv has announced the final closing of its latest vehicle Gimv-XL fund at €609m.

Online retail added to basket

The retail sector has seen increasing dealflow of late with the online sub-sector remaining largely unaffected by economic woes. Mareen Goebel investigates

The public-to-private riddle

Public-to-privates appear to be back in vogue. But why were they so conspicuously absent when stock prices were bottoming out and why are they back now on the back of a prolonged rally? Ashley Wassall investigates

EVCA conference: clear and present danger ahead

The EVCA conference examines the state of private equity and highlights the threat posed by the AIFM directive. Emanuel Eftimiu reports from Geneva

Venture away

Let’s face it, European venture has not got the best standing with global LPs – a result of the tech bubble bursting a decade ago. Although the market should be defined as maturing by now, such generalisations are not easily applicable to a continent...

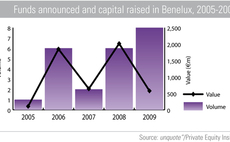

Fundraising set for 2010 uptick after defiant year

According to figures to be published in the upcoming European Fundraising Review 2010, fundraising in the Benelux region has remained resilient in 2009 in spite of the downturn.

Private equity puts retail on the shopping list

Quite surprisingly, the retail sector has been generating significant interest from private equity as of late, indicating that this area of the market has the potential to return to its pre-credit crisis glory. Deborah Sterescu reports.

Advent appoints operating partner for health sector

Advent International has appointed Christian Grenier as operating partner. He will provide advice on investment opportunities in the healthcare and specialty chemical sectors.

Advent names new head of LP services

Advent International has appointed Robert D Brown as managing director and global head of limited partner services.