Benelux

LDC-backed Ensek acquires NrgFin

LDC acquired a significant minority stake in Ensek with HSBC providing leverage in October 2017

Astorg's IQ-EQ buys Conseil Expertise & Synthèse

Add-on is the company's second of 2020, having bought US-based Blue River Partners in March

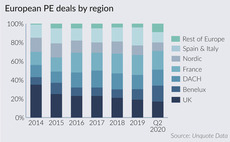

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Programma 102 closes on €100m

VC will launch a new vehicle by the end of the year, with a тЌ100m target, to focus on complementary asset classes

Heal Capital leads $10.5m round for Siilo

Investment in the healthcare messaging app is Heal Capital's debut deal from its first fund

Fund+ leads €23m series-A for Exevir

Exevir will commit to the international effort to pursue new treatment for Covid-19

Gilde Equity Management acquires HC Groep

Gilde has acquired the climate technology and building ventilation company from Airvance Group

Life Science Partners et. al in series-A round for Vico Therapeutics

Biotech startup will use the proceeds to further advance its therapy

Unquote Private Equity Podcast: Calling tech support

This week, the Unquote Podcast talks all things technology with Intuitus chief commercial officer Adrian Astley Jones

Eurazeo China Acceleration Fund invests €80m in DORC

This is the first deal made by the fund, which targets companies with high-growth potential in the Chinese market

Fund+ leads €38m series-B for Indigo Diabetes

Jan Van den Bossche, partner at Fund+, will join the board of the company

Aurelius sells Office Depot's Spanish business to trade

Deal is part of the ongoing restructuring of the company started under Aurelius's ownership

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

PE secondaries volume cut by more than half in H1 - survey

Private debt fund secondaries were hit even harder with an 81.8% plunge, Setter says

GSH Private Capital acquires Getronics in €200m deal

Company currently generates revenues of €300m and employs 4,000 staff

Nuveen Global Impact Fund holds $150m first close

Fund invests in growth-stage companies in developed and emerging markets, with a focus on resource efficiency

PlantLab raises $20m from De Hoge Dennen Capital – report

Company will use the proceeds to expand in the Netherlands, the US and the Bahamas

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Committed Capital buys Intersteel from 5Square

Deal ends a two-year holding period for 5Square, which bought the company from ING and Rikon Holding

Verdane acquires minority stake in Studytube for €10m

Company plans on expanding further into the learning and development market

Munich Private Equity closes third buyout fund-of-funds

Mid-cap buyout-focused fund-of-funds closed on тЌ162m and has made 14 of its 20 planned investments

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

Blackstone Life Sciences V closes on $4.6bn

Fund invests in late-stage rounds of established life science companies and emerging businesses