Benelux

Fortino Capital Partners holds first close on third fund

LPs backing the €45m first close comprise existing investors following the launch in Q1 2020

EC launches €300m platform Escalar

In its pilot phase, Escalar will provide up to тЌ300m, backed by the European Fund for Strategic Investments

Crescent European Specialty Lending Fund II closes on €1.6bn

CESL II invests in a diversified portfolio of private secured debt issued by European companies

Secondaries players hold fire despite copious dry powder

Market is likely to pause until Q2 2020 valuations are released, potentially leading to a flurry in Q4

StepStone closes fourth secondaries fund on $2.1bn

SSOF IV's investment strategy focuses on the inefficient segments of the secondaries market

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

Insight Partners XI closes on $9.5bn

Fund deploys equity tickets in the $10-350m range in startups operating across the software industry

Main Capital-backed Obi4wan buys HowAboutYou

With the support of Main Capital, the group plans to build a software platform and expand internationally

Holland Capital invests in Eshgro

GP first invested in the cloud software provider in 2017 and owns a majority stake in the company

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

Consortium backs $112.5m round for Collibra

Data software company was valued at $1bn post money in its 2019 round and is now valued at $2.3bn

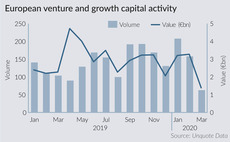

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Cowen Healthcare in €47m extension round for AM-Pharma

Round comprises €23m in equity and a €24m finance facility provided by the European Investment Bank

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

Gradient, Partech lead a $3m seed round for Kaizo

Former partner at IBM Ventures Christoph Auer-Welsbach joins Kaizo as a co-founder

Jerusalem Venture leads $25m series-C for Pyramid Analytics

Investment brings the total funding raised by Pyramid Analytics to $66.5m

Blackstone to continue preparations to acquire NIBC

Blackstone's offer comprises 995 euro cents per share, including the final dividend of 33 cents