Benelux

Bregal Milestone invests €20m in Anywhere365

Anywhere365 founder Gijs Geurts will retain a majority interest in the company

Acquisition prices for SMEs decline in Q1 2020 – research

Prices paid to acquire SMEs declined significantly to 9.3x EBITDA in the first quarter of 2020

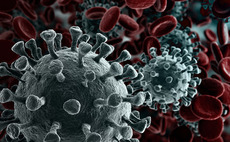

Gilde buys Corilus from AAC Capital

Sale for the healthcare software company began in November 2019 and continued in spite of coronavirus

Q1 Barometer: Year of sustained growth finally halted in Q1

The European private equity market cooled in Q1, even before the Covid-19 crisis took hold, after an especially active Q4 2019

Main Capital Partners raises €564m for sixth fund

Vehicle reached its €564m hard-cap, following a €535m first close in December

Ara Partners closes debut fund on $400m

Fund makes buyout and growth capital investments in companies based across North America and Europe

E-scooter startups feel brunt of lockdowns but anticipate future upside

The coronavirus lockdown in Europe has put a brake on the transport sector - should e-scooter startups and their investors be worried?

Ambienta raises $150m for absolute return fund

Ambienta X Alpha is managed by a team based in London, led by chief investment officer Fabio Pecce

Levine Leichtman backs SIPM MBO

Previous investor Fin.Co sells its majority stake in the company following its investment in 2017

LSP invests €5m in Kiadis Pharma

Company is listed on the regulated market of Euronext Amsterdam and Euronext Brussels

Tech, IT and software valuations remain stable – survey

Report from GCA Altium tracks the effect of the coronavirus crisis on listed technology companies

Omers Ventures Fund IV closes on $750m

Fund targets growth-orientated, disruptive technology companies based across North America and Europe

Omers leads €16.25m series-B for Deliverect

Omers Ventures managing partner Jambu Palaniappan will join the Deliverect board

Parcom holds €775m final close for sixth flagship fund

GP took six months to reach its €775m hard-cap target

Index Ventures raises $2bn across two new funds

Index Ventures Growth V, which targets later-stage companies, raises $1.2bn, while Index Ventures X closes on $800m

MVM invests $14m in MDxHealth

MVM is drawing equity from MVM Fund V, which held a first close on £150m in November 2018

FSN's Fellowmind bolts on ProActive

Add-on follows the GP's acquisition of the IT consultancy in November 2019 via FSN Capital V

Anders Invest buys 50% stake in Topvorm Prefab

GP sees a positive future for the residential construction sector in spite of short-term challenges

Market braces for 12.6% drop in valuations by Q2 – report

NAVs expected to drop for Q1, with a steeper mark-down for Q2 as the crisis take its toll

Unquote Private Equity Podcast: Fund financing in a fix

The Unquote team looks at how PE managers are turning to fund financing in a bid to shore up their portfolios

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Holland Capital exits Inno4Life

Holland Capital provided growth capital and took a stake in Inno4Life in July 2017

KKR expects lower valuations for its portfolios due to Covid-19

GP forecasts that emergency restrictions will challenge its ability to market new funds and strategies

Bolster Investment buys 60% stake in Mark Climate Technology

Climate control systems company will seek add-on acquisitions following the investment