Benelux

Newion backs startup PlayPass

Belgium-based PlayPass, a provider of technology services for events, has raised €7.9m to date

Active's Hendrik Veder bolts on Universal Inspection

Hendrik Veder acquires Scotland-based testing and lifting supply specialist Universal

Prime Ventures sells Greetz to trade

Photobox, backed by Exponent Private Equity and Electra Private Equity, buys Greetz

Ardian in talks to buy Trustteam

Ardian is set to acquire Belgium-based IT company Trustteam, owned by Naxicap since 2014

Avedon sells CycloMedia to Volpi in €100m deal

Investment in Netherlands-based B2B geospatial data business generates a 5x return

Main buys Enovation from Vanad

Vanad Group is a family owned industrial holding company with a portfolio of 11 companies

European secondaries up 50% year-on-year – report

Western Europe deals saw the largest increase in H1 compared with other geographies, says Setter

IK prepares for minority stake fund launch

IK Investment Partners began registering vehicles for the fund in April earlier this year

De Hoge Dennen sells Mybrand to Conclusion

Sale ends a three-year holding period for the investor, which acquired a majority stake in 2015

Bencis takes over Fit For Free and SportCity from Avedon

Avedon invested in the Dutch fitness chains in 2009, supporting the roll-out strategy

KKR, Schroders back Neos direct lending JV

KKR is the principal investor in the vehicle and is drawing the investment from its credit funds

GMT, VSS sell IT-Ernity to trade

GMT made the original investment from its third fund, a €250m 2007-vintage buyout vehicle

Felicis closes sixth fund on $270m

Felicis has a global investment mandate and has previously invested in 40 countries

Nystrs considering further European fund commitments

US pension fund has increased the number of active partnerships in its private equity portfolio

Waterland buys Debuut

GP secures a majority stake in the Dutch restaurant group from the company's founder

Strong exit environment helps drive Pantheon's returns

Sales to corporate buyers were the most significant source of exits, PIP says in its results

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

Nordic Capital acquires Excent Tandtechniek

Deal was made as an add-on to Nordic Capital's European Dental Group platform

Riverside promotes Álvarez-Novoa to partner

Firm also appoints Filip Van de Vliet and Philip Rowland as operating partners

Hamilton Lane asset footprint hits record high

Firm plans to keep growing its existing funds across primary, co-investment and secondary strategies

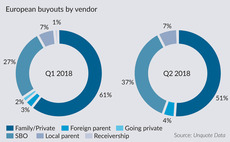

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

Keen Venture leads $22m series-C for Teamleader

Firm will use the new capital to sustain international growth and accelerate product development

VC firms sell Mendix to Siemens for €600m

Mendix has raised $38m in equity funding from VC firms since it was founded in 2005

NPM acquires stake in Ploeger Oxbo

New funding is intended to bolster Ploeger Oxbo's innovation and product development