CEE

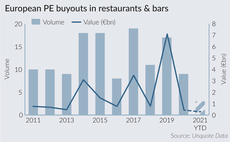

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Leta launches $100m fund to back Russian-speaking founders

GP will focus on eastern European and Russian-speaking founders who it believes are undervalued and overlooked for funding

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising

PE deal-making surge of 2021 could break one more record

Recent trends in the mega-deal segment indicate that the Alliance Boots buyout of 2007 is a record that is close to being broken

VC fundraising enjoys strong 2020 vintage, sunny prospects

With record amounts of capital raised for the strategy, venture capital fundraising does not appear to have been slowed by the pandemic

DN Capital's Global Venture Capital V surpasses €200m

GVC V targets seed and series-A investments in the software, fintech and online marketplace sectors

Balderton holds final close for $680m debut growth fund

GP's previous vehicles have targeted earlier-stage primary and secondary venture deals

Unquote Private Equity Podcast: Pandemic premiums

Following the publication of the Q1 2021 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

Pollen Street Capital IV raises £560m, close to surpass target

PSC IV invests in lower-mid-market companies across the financial and business services industries

Cerea Mezzanine IV holds €215m first close

Fund invests in small- and mid-cap companies operating across the food and beverage value chain

Heritage funds: Large-cap players explore mid-cap opportunities

With Astorg on the road, and Triton and PAI having closed smaller funds this year, Unquote looks at what is driving the trend

CapVest gears up for launch of CapVest V

GP backs mid-market companies in essential goods and services; it sold Valeo Foods to Bain for тЌ1.7bn in May 2021

Unquote Private Equity Podcast: First-time fortunes

Vincent Van den Brink and Greg Kok from fund administrator JTC discuss how recent months have affected the fortunes of first-time funds

TA Associates closes TA XIV fund on $12.5bn

Firm also closes its second-generation re-investment fund, TA Select Opportunities Fund II, on $1.5bn

Pandemic success boosts appeal of "misunderstood" gaming sector

PE and VC interest for the sector has picked up in the past few years after a lull, and the pandemic could turn some of these bets into winners

Riello launches €80m agri-food venture fund

Linfa Ventures will be dedicated to late-stage and growth capital investments across the agri-food sector

Multiples Heatmap: hectic Q1 further fuels valuation hike

Deal multiples saw four consecutive quarterly increases to reach 11.5x in the first quarter of 2021

Ysios Capital closes third fund on €216m

Fund provides private equity financing to early- and mid-stage life sciences companies

Bain Capital Ventures Fund 2021 raises $1.3bn

Fund intends to focus on digital commerce, fintech, digital healthcare and cloud infrastructure

Merieux Participations 4 holds €300m first close

MP4 provides equity tickets of тЌ20-80m, with a sweet spot of тЌ40-45m, targeting the health and nutrition sector

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching тЌ12.7bn

OpenGate heads for third fund launch targeting up to $700m

GP is currently investing its second fund, which held a final close on $585m in November 2019

Neuberger Berman launches ELTIF

Fund focuses on buyout opportunities blended with some growth and structured equity