CEE

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

BaltCap sells Ecoservice to PE-backed Eco Baltia

BaltCap's exit comes seven years after the GP acquired a 75% stake in Ecoservice for €16.4m

EQT Growth leads €250m series-F round for Vinted

Latest round brings the total amount Vinted has raised to nearly €500m

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Airbridge Investments contemplates new fundraise

Fund could tap family offices and wealthy individuals, while the VC's founders have so far invested their own capital

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

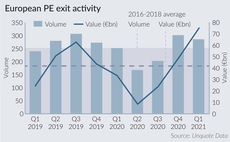

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

FlyCap targets €25-35m for mezzanine fund

Latvian government's development finance institution Altum commits around 60% of the fund

LP Profile: PFR increasingly eyeing funds outside Poland

Polish LP has invested €75m in four private equity firms in recent months, including Apax Partners, PAI Partners and Avallon MBO

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries

AlpInvest Co-Investment Fund VIII closes on $3.5bn

ACF VIII invests alongside GPs in private equity buyouts and growth capital transactions across a variety of sectors

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Inovo II holds €54m final close

Fund intends to fuel the development of the startup ecosystem across the CEE region

Cusp Capital announces €300m debut fund

Newly launched VC is led by former Tengelmann Ventures partners and managing directors

Primo Digital Fund launches with €80m target

Fund has a special focus on the e-commerce, software, cybersecurity, fintech and blockchain sectors

Resource Partners buys dog food maker Atlantic Products

GP plans to merge Atlantic with portfolio company Maced, in which it acquired a majority stake last year

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

Tera Ventures closes second fund on €43m

According to Unquote Data, the fund was launched in January 2018 and had a target of raising €55m

BaltCap closes third fund on €177m hard-cap

GP committed €5m of its own capital to the fund, the largest amount it has committed to any of its own funds