CEE

Revo Capital nears final close for Fund II

Venture capital firm is also eyeing two more investments in September, according to MD Cenk Bayrakdar

Unquote Private Equity Podcast: Climb in pricing persists

Following the publication of the Q2 2021 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

Genesis Capital raises EUR 101m in first closing of GPEF IV

Fund aims to raise up to EUR 150m from institutional investors by the end of 2021

AGIC to sell Fotona to Vitruvian

AGIC is to retain a stake in the Slovenia-based medical and dental laser company

Q2 Barometer: Robust Q2 performance bodes well for H2

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Multiples Heatmap: PE continues to pay ever more for assets

Deal multiples record a fifth consecutive quarterly increases to reach 11.8x in the second quarter of 2021

TCV-backed Grupa Pracuj files for IPO

TCV owns a 27% stake in the Poland-based recruitment platform, with the remainder held by management

No sign of summer holiday for PE as dealflow beats records

In June and July 2021, deal volume surpassed 2019's record by 13%, with aggregate value up by 33%

Stock Spirits agrees to CVC acquisition offer

Share price spikes to 383 pence per share following the GBP 767m offer for the distiller

Karma Ventures gears up for second fund

Estonia-based VC held a final close on EUR 70m for its inaugural fund in 2018

Getir investors to cash in USD 100m with secondary sale

Stake being sold amounts to around 1.3% of Getir's total share capital

Secondaries activity rebounds to record USD 55bn in H1 – survey

Direct secondaries account for the majority of transactions for the first time ever, says Setter Capital

Bolt closes EUR 600m funding round

Investors include Sequoia, Tekne, Ghisallo, G Squared, D1 Capital and Naya

Houlihan Lokey to buy GCA

GCA Altium and GCAтs US business will operate under the Houlihan Lokey brand

Ambienta sells Calucem to Cementos Molins in EUR 150m deal

Calucem reports a turnover of EUR 58m, with an EBITDA of EUR 16m

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

A&M Capital Europe buys Pet Network for EUR 260m

Pet Network was created by TRG in 2018 through the acquisition and merger of three businesses

GPs increasingly ruling out investments due to ESG – survey

Majority of GPs polled by Investec have declined to invest in a company on ESG or ethical grounds

One in four LPs willing to trade lower performance for better ESG - survey

ESG-focused LPs "motivated to divest positions in funds where they perceive ESG efforts to be lacking"

Mid Europa explores sale of M+ Group

Owners of M+ Group appoint William Blair to assess strategic options for the company

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

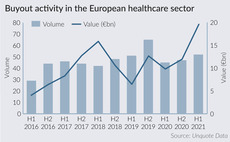

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe