CEE

ESG: PE leading the charge in CEE

Growing maturity of the market has been gradually bringing local standards up to western European levels

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

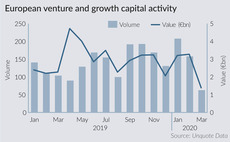

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Consortium in $150m round for Ozon.ru

Financing round is in the form of a convertible loan that can be turned into equity

Hoxton leads $10m series-A for learning platform Preply

Point Nine Capital, All Iron Ventures, EduCapital and Diligent Capital also take part in the round

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Pomerangels backs round for Fully-Verified

Fresh capital will be used to strengthen the company's position in the worldwide identity verification sector

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

Revo Capital Fund II holds first close on €40m

Domiciled in the Netherlands and structured as a BV, the fund has a 2% management fee

Arx reaps 3.6x on DCB trade sale

Divestment generates an overall cash-on-cash return of 3.6x and an IRR of more than 25%

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

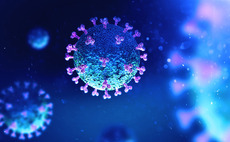

Coronavirus and private equity

All our latest coverage on the ongoing coronavirus crisis, and its impact on the European PE industry

Secondaries buyers expect 30% volume drop over next two months - research

Five out of 37 buyers still appear opportunistic and expect activity to go up

Mediterra exits Mobiliz to GPS Bulgaria

Mediterra acquired Mobiliz for a total consideration of €5.05m in November 2012

Integral holds first close for debut fund

LP base currently includes institutional investors, as well as regional and international entrepreneurs

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors

Innova to exit Polskie ePlatnosci in Nets sale

Innova Capital and other shareholders are to sell a total of 79.49%, and OPTeam is to sell 20.51% in PeP