CEE

INVL inches closer to second Growth Fund

Work on Fund II could start once INVL’s debut vehicle is 75%-80% deployed, following two to three more deals

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Spire Capital gears up for first close for EUR 110m fund

Polish tech-focused sponsor is centring fundraising efforts for its debut vehicle on institutional LPs

Unigestion launches third Direct fund with EUR 1bn target

Strategy invests in mid-market companies alongside the GP's investment partner network

LPs' net returns highest since financial crisis – Coller Capital

Secondaries specialistтs Summer 2022 Barometer shows that half of LPs want to increase their allocation to alternatives, with 91% still committing to PE first closes with incentives

Genesis holds EUR 150m final close for GPEF IV

Czech Republic-headquartered GP reached its hard-cap with a EUR 15m commitment from the EBRD

GP Profile: Jet Investment doubles down on industrial impact ahead of next fundraise

Central European industrials-focused GP is in the planning phase for Jet 3 Fund and is eyeing further deals and exits

Re-Pie to raise single-asset fund for Muslim fashion retailer

Turkish GP will onboard investors to the fund until 31 May; proceeds will back Modanisa’s expansion

Tikehau, Unilever, Axa form EUR 1bn impact fund

Each party has made a EUR 100m commitment and the agriculture-focused fund is now open to new LPs

Schroders gears up for new VC fund-of-funds

Schroders Capital Private Equity Global Innovation Management XI has been registered in Luxembourg

LongeVC mulls 2023 fundraise for second fund

Biotech-focused VC could hit the road for new USD 180m-200m vehicle once Fund I’s hard-cap is reached

Bridgepoint explores sale of childrenswear and toy chain Smyk

Beauty contest to select financial advisor for the auction of the Polish business was held earlier this yea

Gramex Drinks sponsors in bilateral talks with strategic suitors

Owners ARX Equity and Structured Capital are evaluating offers against other options for developing the Hungarian soft drinks maker

Western Balkans PE Fund gears up for debut vehicle first close

With a EUR 15m- EUR 20m close set for October, new SME-focused fund will now look to attract institutional investors from across Europe

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Getir backer Re-Pie launches EUR 70m VC fund

Re-Pie Ventures 1 plans to hold a first close by the end of 2022, general partner Mehmet Ali Ergin said

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

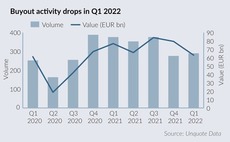

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

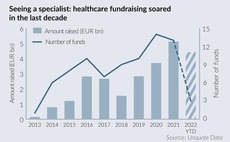

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

Pamplona to liquidate LetterOne-backed funds, to sell LP stakes in cut-off process

GP to begin formal wind down process on three funds after sanctions hit the LPтs Russian backers

Innova exits Trimo for 4.5x money

Deal values the Slovenian buildings supplier at 9.5x 2021 EBITDA; GP's 2020 exit attempt collapsed after lengthy competition process

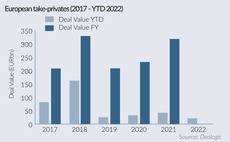

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again