CEE

Vitruvian starts fundraising for VIP V

New vehicle registered this month; presented to Los Angeles-based LPs

ICG on EUR 10bn-plus direct lending fundraise for large deals

New unitranche fund will be on par with Aresт latest, which has a target north of EUR 11bn

Cinven's Partner in Pet Food tipped as exit candidate for 2023

Auction could launch as early as Q2 2023, sources says; GP says no plans for sale next year

H.I.G. poaches Alcentra director to lead European capital markets coverage

Philippe de Limburg Stirum will transition from direct lending into private equity at new firm

Second-hand: could continuation vehicles become 'SPACs of 2022'?

As the pace of secondary fundraising and deals gains momentum, some challenges start to arise

Orbit Capital aims for EUR 200m with new scaleup fund

Czech GP targeting institutional investors for CEE-focused vehicle following first close at EUR 42m in December

GP Profile: Tyrus Capital plans secondaries deployment drive

Mature and tail-end secondaries opportunities on the rise with motivated sellers seeking to organise their portfolios, Gunter Waldner tells Unquote

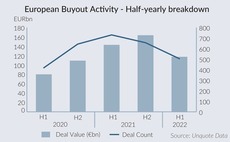

Q2 Barometer: Value and volume bifurcation sets in

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

The Bolt-Ons Digest - 19 August 2022

Unquoteтs selection of the latest add-ons with Apax's Groupe Crystal, Livingbridge's CitNOW, Tritonтs Fertiberia and more

Buy now, realise later - sponsors go on spending spree amid exit lull

Mounting dry powder sees GPs turn to primary buyouts, P2Ps and carve-outs, although exit pressure remains

Contrarian Ventures targets EUR 100m hard cap for new climate tech fund

Lithuanian VC aiming to attract funds-of-funds for second close planned for the next month

Mid Europa Partners readies software developer Intive for sale

Goldman Sachs will advise on auction for Germany-headquartered company, expected to launch in Q4

SVPGlobal poaches Beach Point Capital's Himot

Following a 12-year tenure at Beach Point, Himot joins forces with the US-based investment firm

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist also set to start fundraising for EUR 250m food tech vehicle next month

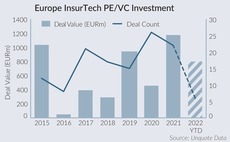

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

Deutsche Bank head of EMEA equity-linked departs

Xavier Lagache is no longer in the role after more than a decade; replacement not announced

ACP holds EUR 90m first close for debut credit fund

Fund aims to bridge the lending gap for Central European lower mid-cap businesses, complementing existing bank lending

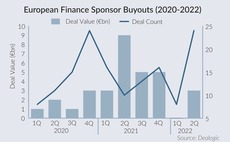

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

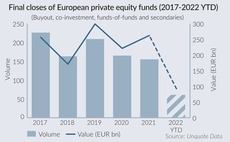

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Superangel targets up to EUR 50m hard cap for second fund

Estonian VC firm seeks further institutional investors; SmartCap to make EUR 15m anchor commitment

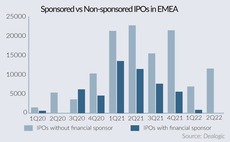

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments