CEE

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

Genesis buys majority stake in HC Electronics

GP is investing in the electronics manufacturing firm via its EUR 40m Genesis Growth Equity Fund I

Dawn Capital eyes two new funds

Software-focused VC makes early-stage deals; its Opportunities funds back its later-stage portfolio

Bogazici Ventures to establish three pre-IPO VC funds

Turkish GP looks to raise a total of USD 17m to deploy in biotech, gaming and fintech late-stage startups

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Mid Europa hires Vesna Sipp from ICG

Sipp will join as head of investor relations

Digital Horizon set for USD 200m Fund II first close in Q2 2022

VC started marketing the fund in December 2021 and has USD 100m in soft commitments to date

Bridgepoint hires Houlihan Lokey for Dr Gerard exit

Preliminary marketing materials for the Polish biscuits maker are expected imminently

Gilde Healthcare buys Europin

The GP will merge it with portfolio company Acti-Med

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

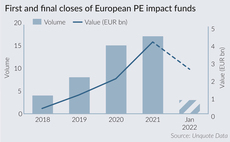

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

Abris exits Patent Co to trade

Sale to Raiffeisen Ware Austria ends Abris's six-year investment period in the animal feed company

Abris buys dentistry supplier Dentstore

Dentstore is Abris's third acquisition in the dental supplies sector, after Dentotal and Dentechnica

Eleven Ventures announces EUR 60m fund

Eleven Fund III is 10x bigger than its predecessor fund, which launched in 2018 and closed on EUR 6m

Buy-and-build a "super opportunity" for PE in healthcare services – panel

Dermatology, ophthalmology and diagnostic imaging all present attractive consolidation opportunities, panellists said

Petershill IV closes on USD 5bn

Petershill Partners is operated by Goldman Sachs Asset Management and buys minority stakes in GPs

Sequoia, Fidelity in EUR 628m investment round for Bolt

Ride-hailing service reaches a valuation of EUR 7.4bn, up from EUR 4bn at its last funding round in August 2021

TA, LEA to merge Enscape, Chaos

LEA bought Enscape in 2020

Getir to raise more than USD 1bn at USD 12bn pre-money valuation

Getir raised a total of USD 1.1bn in three consecutive rounds in 2021

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe