DACH

Quadriga buys GBA from Adiuva

Acquirer invested via Quadriga Capital Private Equity Fund IV, which closed on €529m

Equistone acquires fire proofing business Roth

During Ufenau's ownership, Roth made four add-ons in different Swiss regions

HTGF provides seed funding for Raidboxes

High-Tech Gründerfonds usually invests €600,000 at seed stage in its portfolio companies

Sonya Pauls leaves KWM for Clifford Chance

Pauls will join Clifford Chance as a partner in the investment funds team on 1 October

DPE sells Westfalia to Horizon Global for €125m

Following the deal, DPE will become the largest shareholder in Horizon Global with a 10% stake

Earlybird holds first close for health tech fund

VC targets €120m for the North Rhine-Westphalia-based vehicle

Equistone-backed TriStyle bolts on Long Tall Sally

Acquisition marks first bolt-on investment since the GP invested in the fashion retailer

Alpina acquires Cimdata to merge it with Oxaion

Deal marks the first bolt-on as part of a buy-and-build growth strategy in the ESP space

DBAG in secondary buyout of R&M from Nord Holding

German ships interiors business has expanded via an international acquisitive strategy

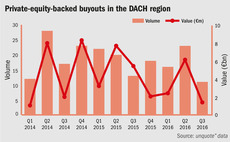

DACH buyout dealflow hits 15-month high in Q2

Buyout volume and aggregate value were up by 43% and 155%, respectively

Apax-backed InfoVista acquires Ascom's Tems subsidiary

Apax France acquired a majority stake in the group in March 2016

DN Capital starts fundraising for €200m fourth vehicle

Venture capital firm's previous fund held a тЌ144m final close in September 2014

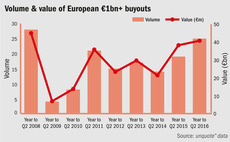

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

ProteoMediX raises CHF 5m from Altos Venture et al.

Altos has been backing the Zurich-based diagnostic tests company consistently since 2012

Akina holds interim closes on three Euro Choice funds

All three funds are expected to hold a final close by the end of the year

HQ Equita exits Windstar Medical in trade sale

German GP exits over-the-counter drugs maker less than two years after acquisition

DACH managers benefiting from fundraising tailwinds

The DACH region has enjoyed a busy first half in terms of fundraising, particularly in the venture space

Equistone acquires United Initiators from Vision and Speyside

Vision Capital had acquired a majority stake in the group from Speyside in 2011

Alpina exits Via Optronics in €47.4m trade sale

Alpina had been a shareholder in the screen technology business since 2010

Food tech: first warning signs as consolidation sets in

Deliveroo's $275m round shows the market remains frothy, but other recent news highlight the challenges facing startups and their VCs

Avedon Capital exits Tesch Inkasso

GP acquired the business in 2012, aiming to implement a buy-and-build strategy

Octopus Ventures leads $22m round for Outfittery

Existing backers including Northzone, Highland and Holtzbrinck also take part in the round

DBAG exits Broetje-Automation

DBAG became a majority shareholder in the group in 2012, investing through DBAG Fund V

Deal in Focus: Waterland sticks to buy-and-build strategy with Median

The post-acute clinic business has made its 15th acquisition under the GP's tenure, with its latest bolt-on of AHG being one of the largest