DACH

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

Mosaic, Santander in funding round for Bonify

Experian Ventures and the founders of fintech company Raisin also take part in the investment

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

DBAG acquires Congatec

MBO of the computing and robotic components producer is the second deal from DBAG Fund VIII

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

HSBC Vision Private Equity 2020 closes on $260m

Fund targets a variety of private equity opportunities, from primaries and secondaries to direct co-investments

EMZ acquires HRWorks

EMZ recently opened its first international office in Munich, headed by partner Klaus Maurer

Consortium in $100m round for Omio

Fresh capital will be used for organic growth activities and M&A opportunities

Capvis buys Business Systems Integration

GP deploys capital from Capvis Equity V, which held a final close in September 2018 on €1.2bn

Global Brain extends series-A for Element Insurance

Global Brain is investing from its SFV GB Fund, a joint venture between Sony Financial Ventures and Global Brain Corporation

Bid acquires Pisa Sales

Bid is expected to merge Pisa with portfolio company Infopark, which it acquired in August 2020

Vangionen Capital backs Guenter Hofstetter

Vangionen is acquiring the company following its filing for bankruptcy at a court in Heilbronn in June

Waterland's Beck Et Al buys InfoWan

IT cloud service group now comprises four businesses and was formed by Waterland in May 2020

CVC's Syntegon sells Viersen-based operations to trade

CVC acquired Syntegon Technolgy in a carve-out from Robert Bosch in 2019 via its seventh fund

Adiuva-backed Konzmann acquires Trenker

Building services provider has made 12 add-ons since Adiuva Capital first invested in 2016

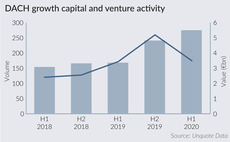

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Deutsche Beteiligungs AG acquires Multimon

Acquisition of the fire safety systems provider is the first from the GP's €1.1bn eighth fund

Advent buys 30% stake in Aareon

Deal gives the property software company an EV of €960m, with Advent's stake valued at €260m

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

Occident leads CHF 5.1m series-A for Hemotune

Also backing the biotech startup were the Zürcher Kantonalbank and Greencross Medical Science Corp

VCs in €5m round for Klima

EVentures, 468 Capital and HV Holtzbrinck back the round for the climate change mitigation app

La Famiglia announces second fund

B2B-focused venture capital fund has made eight investments so far and is targeting €50m

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

HQ Equita buys majority stake in Muegge

Microwave components producer was acquired from its parent company Meyer Burger Technology