DACH

StepStone closes fourth secondaries fund on $2.1bn

SSOF IV's investment strategy focuses on the inefficient segments of the secondaries market

Callista acquires ETM from BOS

Callista intends to continue the strategic repositioning of ETM and to expand its customer base

Investcorp acquires Avira for $180m

Deal is the seventh from Investcorp Technology Partners IV, which held a final close on $400m in December 2018

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

Family Trust Investor buys AlphaQuest

Investment in IT consultancy firm is the third from the Munich-based GP's debut fund

EQT enters exclusive negotiations to acquire Schülke

Sale process saw EBITDA adjustments due to the hygiene product company's increased revenues

Xpension raises €25m series-C round led by HPE Growth

Company has raised more than €50m in funding so far.

Patrimonium holds €100m first close for debut fund

GP aims for final close within 12 months, despite the ongoing impact of Covid-19

Insight Partners XI closes on $9.5bn

Fund deploys equity tickets in the $10-350m range in startups operating across the software industry

Ufenau buys majority stake in Ikor

Investment in the Hamburg-based digitalisation consultancy is the second from Ufenau VI

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

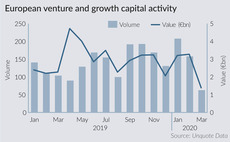

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Quantum-backed Postcon sells subsidiary Pin

GP originally acquired the Germany-based postal service operator from PostNL in 2019

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

C Ventures leads series-A for Agile Robots

AI-backed robot and robotic software developer plans to use the fresh capital to develop its product

DBAG-backed Vitronet buys Telewenz

Bolt-on of cable installation market peer is subject to competition authority approval

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Deimel joins YielCo from SwanCap

Manuel Deimel will take on the role of head of co-investments, having spent six years at SwanCap

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

Bain & Company appoints new DACH head of PE

Alexander Schmitz will take over the role from Rolf-Magnus Weddigen from 1 April 2020