France

Five Arrows Principal Investments backs A2Mac1

FAPI acquires French automotive benchmarking provider for a total of €200m

Q3 Barometer: Market pauses for breath

European dealflow slows down compared with previous quarter but remains at historically elevated level

Entrepreneurial spirit helps French VC fundraising rebound

Venture fundraising reaches 2016 levels with two months left of the year, with early-stage and expansion dealflow also on the up

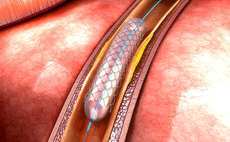

Sofinnova leads €12.3m round for Highlife

Following the deal, Sofinnova will become the largest shareholder in the business

Galia Gestion, Alliance Entreprendre back Barbarie

GPs replace owner and LT Capital as investors of pallet boxes business Barbarie Groupe

Ardian backs management buyout of Babeau-Seguin

Ardian buys the French detached house builder Babeau-Seguin from Nixen

Truffle et al. exit Vexim in €162m Stryker deal

US-based Stryker Corporation acquires French VC-backed company Vexim for €162m

Idinvest Partners, BPI France et al. in €32m iAdvize series-C

French GPs invest €32m in the conversational marketing platform developer

Majority shareholder IDI exploring options for Idinvest stake

Idinvest could add to the wave of consolidation in the PE space as IDI mulls a potential sale

Gimv, UI Gestion sell Almaviva Santé to Antin

Gimv and UI Gestion sell the French private hospitals group to Antin Infrastructure Partners

BC Partners acquires MCS

GP acquires a 90% stake in the French bank loans portfolio management company

Omnes Capital promotes five, hires three

French private equity firm expands its buyout, venture, infrastructure and support teams

Capzanine hires Muller for investor relations team

Frédéric Muller leaves First Avenue after nine years to join the France-based alternative lender

BPI France and UI Gestion acquire Theradial in MBO

GPs jointly acquire a majority stake in the French medical equipment distributor

Kartesia closes latest fund on €870m hard-cap

Alternative lender says it was on the road for nine months, raising тЌ360m more than for Fund III

Korelya to manage extra €100m on behalf of Naver

Venture player Korelya is headed by former French secretary of state Fleur Pellerin

NextWorld Evergreen invests €20m in Kusmi Tea

GP takes a minority stake in Orientis's tea branch Kusmi Tea as part of a capital increase

Otium Capital and Kima Ventures in €2m round for Comet

Venture capital funds back startup, which connects freelancers with companies who need staff

Isatis Capital invests €4m in Web100T

MBO of the medical administration software developer is supported by senior debt from LCL

Céréa Partenaire invests in Organic Alliance

Sale ends a three-year holding period for Naxicap Partners, which created the company in 2014

Ixo et al. in €7.3m round for Antabio

Irdi Soridec Gestion, Galia Gestion and the company’s previous investors also take part

Capital Dynamics holds $383m final close for co-invest fund

Vehicle surpasses its $350m target after holding an interim close on $200m in May 2017

CM-CIC Investissement, BNP Paribas back Taranis

CM-CIC Investissement invests €3.3m, while BNP Paribas Développement injects €1.9m

Bridgepoint to acquire 5àSec from Rive et al.

Bridgepoint is to acquire the French dry-cleaning group from its current private equity backers