France

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Worldline's sale of TSS to Apollo stalls over deal terms

Apollo's offer was estimated to be a little short of EUR 2.5bn when it entered exclusive negotiations over the summer

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

DWS holds USD 550m final close for first PES fund

GP's first institutional fund will partner with lower- and mid-market GPs for mid-life secondaries

General Atlantic flagship fund GA 2021 closes on USD 7.8bn

Sixth flagship growth equity fund is more than twice the size of its USD 3.3bn predecessor

LBO France secures Alliance Marine takeover from Weinberg

Deal values the target at around EUR 200m (10x EBITDA), according to Capital Finance

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Argos Wityu exits Olinn

GP formed the equipment leasing and management firm in 2018 via the merger of four companies

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Eurazeo grew AUM by 44% over past 12 months

Asset manager raised EUR 3bn from limited partners in the first nine months of 2021

Activa Capital hires associate in investment team

Prior to joining, Julie Perouzel worked as an M&A analyst at Rothschild & Co for a year

Auction for Carlyle's Saverglass called off – report

Rothschild-run process was launched earlier this year, with Towerbrook and ICG reportedly involved in earlier stages

Ardian, Latour buy LBO France's Groupe RG

LBO France bought a majority stake in the personal protective equipment producer in 2017

Gimv to exit Wolf Lingerie in Vulcain-led auction

Gimv and Alsace Capital acquired Wolf from Cathay Capital and EPF Partners in 2014

ESG concerns limit bidders in LMB Aerospace sale

First-round bids for France-based LMB Aerospace were collected last week

Kempen holds EUR 173m first close for European Private Equity Fund II

New fund is focused on small and lower-mid-market private equity buyouts in Europe

LBO France, PAI in second round for Alliance Marine

Alliance Marine went on a bolt-on shopping spree under Weinberg ownership

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

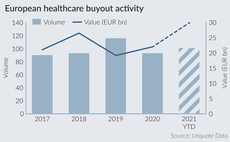

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

Anaveo sale pulled despite late-stage talks with 3i

Competitive process stalls as vendor Bridgepoint's price expectations were not met, sources say

France's Apax appoints chief sustainability officer

Dominica Adam has taken up the newly created management position at the Paris-headquartered GP

IK invests in Prophecy Group

Minority investment in the cybersecurity firm is IK's sixth deal to be announced in H2 2021

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations