France

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

White Star holds USD 360m final close for Fund III

Growth technology VC held a final close for its predecessor vehicle in 2018 on USD 180m

Leveraged loans issuance sets new record

High-yield bonds backing LBOs followed a different route, with volume decreasing 67% from Q2

Mirova contemplates first growth fund as follow-up to ESG vehicle

Firm is eyeing the launch of a growth fund once its recently launched ESG vehicle reaches 75% deployment

IK hires Lazard to advise on Linxis sale

IK acquired Linxis Group (then Breteche) from Cerea Partenaire, Capza and Equistone in July 2015

Pantheon raises USD 624m for GP-led secondaries programme

Unquote recaps the fundraise and investment strategy with managing partner Paul Ward

LBO France in EUR 500m Franco-Chinese venture with Haixia Capital

MoU marks LBO France's first foray into the Chinese market, with plans to open a local office

Asmodee already attracting PE interest ahead of November launch

Silver Lake, CVC, Advent and KKR are already set to join the race, sources say

Saverglass sale hits snag with remaining bidder Lone Star

future capex spend is a worry for bidders and lenders, sources say

Committed Advisors closes CAPF I on EUR 161m

Primaries, early secondaries and co-investment fund is intended to extend the GP's existing strategy

EQT launches EQT Future fund

Fund has a EUR 4bn target and intends to make impact-driven investments in mature companies

LBO France holds EUR 155m final close for Digital Health 2

GP previously raised EUR 70m for SISA, a fund dedicated to healthcare technology

Sofinnova holds EUR 472m final close for Capital X

France-headquartered VC will continue to focus on early-stage healthcare investments

One third of LPs plan to increase PE allocation within a year – survey

Schroders' Institutional Investor Study surveyed 750 investors in February and March 2021

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

Jasmin Capital promotes new partner

Placement agent and secondaries adviser also promotes three and hires a new associate

TA Associates takes minority stake in Foncia

TA secures a 25% stake, while Partners Group remains the controlling shareholder

Ace Capital raises EUR 175m for cybersecurity fund

Brienne III held a first close on EUR 80m in June 2019 and ultimately exceeded its target

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

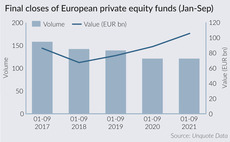

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend