Nordics

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

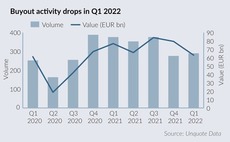

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

SEB Private Equity sells Norcospectra to Accent

Commercial interiors business is expected to expand via add-ons and develop its digital offering

Ganni sponsor L Catterton appoints Lazard to explore sale

Denmark-headquartered online fashion retailer could come to market in H2 2022, Mergermarket reported

Altor in early dual-track preparations to exit Transcom

Rothschild is mandated as sale adviser for the Swedish BPO group, while JP Morgan will advise on IPO track

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Accent exits Motum to Mitsubishi Electric

Sale of Swedish elevator services group marks the 12th exit from the Accent Equity 2012 fund

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

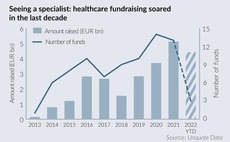

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Adelis launches majority stake sale of Knightec

GP is being guided by Carnegie in the exit from the Swedish technology consultancy

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

Segulah sells NVBS Rail Group to Ratos

Exit sees NVBS acquire Finland-based Ratatek; the group's EV is EUR 103m with a 9.4x EBITDA multiple

FSN readies IT consultancy Nordlo for exit

Danske Bank is among advisers in the upcoming auction, which could see the Sweden-based asset marketed off EUR 25m-30m EBITDA

Hg invests in EQT, TA backed IFS and WorkWave

EQT VIII exits majority of its positions and reaps 3x money after two years invested in the cloud software companies

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

IK Partners invests in Sitevision

IK Small Cap III will hold minority stake while founders will reinvest and remain majority owners

Trill Impact set for venture fund following Domin appointment

Alex Domin has joined the Stockholm-headquartered impact investor as co-head of ventures

Altor Equity acquires minority stake in Svea Solar

GP becomes lead investor in the Swedish cleantech with purchase of all shares owned by Axel Johnson-backed Axsol

EMK Capital gears up for third fund

European mid-market investor held a final close for its predecessor fund in 2020 on EUR 1.5bn

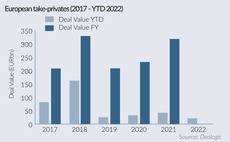

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

GRO Capital holds EUR 600m final close for Fund III

B2B software-focused fund is more than twice the size of its EUR 255m, 2018-vintage predecessor

Nordic M&A to withstand mounting macro and geopolitical pressures - panel

Restructurings, take-privates and US interest on the rise, while Q1 2022 buyouts are likely to drag behind