Nordics

2011 a bumper year for Nordic fundraising

Fundraising activity declined slightly in 2011 compared to the previous year, as the market remains tough and LPs selective. Not all European regions fared equally though, with the Nordic countries and France attracting significant amounts of capital....

Hope takes charge of Swedish legal firm

Maria-Pia Hope has been appointed new managing partner of Swedish legal firm Vinge.

Nordic investments collapse in Q4 2011

Nordic private equity investments fell off a cliff in Q4 2011, according to data from the latest unquoteт Nordic Private Equity Index, in association with KPMG.

Deal volumes hit 15-year low

Deal volumes in Q4 2011 hit their lowest levels since 1996, in a difficult final quarter for the private equity industry, according to the unquoteт Private Equity Barometer, in association with Arle Capital Partners.

Debt providers: "One-stop shops" gaining ground

Faced with a tough bank lending environment, PE houses are increasingly turning to тone-stop shopsт to leverage their deals. Indeed, alternative debt providers are looking forward to a busy 2012, as Greg Gille finds out.

Reiten-backed NEAS divests consulting business

Reiten & Co listed portfolio company NEAS has divested its consulting engineering business to trade player Sweco Norway.

EQT exits Lundhags

EQT has exited outdoor clothing company Lundhags to Norwegian trade player Swix.

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

AIFMD moves EQT funds onshore

EQT has announced that it will domicile its next fund within the EU.

Nordic unquote" January 2012

The Swedish tax authorityтs battle over carried interest taxation continues as another player is drawn into the feud.

Dechert opens in Frankfurt; poaches Mayer Brown partner

Private equity specialist Dr. Benedikt Weiser will join Dechert next month from Mayer Brown, where he was head of the firmтs German Private Investment Funds group.

Norvestor to take Inmeta Crayon private

A take-private of Norwegian technology consultancy Inmeta Crayon by Norvestor draws closer as significant shareholder CapMan accepts a public offer.

Polaris backs Skånska Byggvaror

Polaris Private Equity has acquired a majority shareholding in Swedish DIY retailer SkУЅnska Byggvaror.

Sentica's Arjessa Group bolts on Jokilaakson Perhekodit

Sentica's portfolio company, child welfare service provider Arjessa Group, has acquired trade player Jokilaakson Perhekodit (JP) in a share-swap.

Odin Equity buys Scandinavian food distributors

Odin Equity has taken a majority stake in Danish food distributors SFK Food and W. OschУЄtzchen Уrhus (SFK/OTZ).

Have your say: Nordic Private Equity Index

After a disappointing third quarter, fortunes for the Nordic market continued to deteriorate in Q4.

FSN Capital buys PM Retail

FSN Capital has acquired Norwegian women's clothing retailer PM Retail.

PAI offloads 25.66% of Chr. Hansen for €560m

PAI Partners SAS has agreed to sell 25.66% of its Chr. Hansen shares worth тЌ560m to Novo A/S.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

DN highlights venture revival

Six exits in 18 months; two portfolio companies bought by Oracle in 2011 alone. One firm is living the dream. Kimberly Romaine reports.

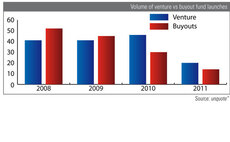

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

Access Capital Partners closes fund on €500m

Access Capital Partners has held a final close of its fifth European small- and mid-market fund-of-funds, Access Capital Fund V Growth Buy-out Europe (ACF V), on тЌ500m т above its initial target of тЌ350m.

BaltCap backs Labochema

BaltCap has completed an investment in pan-Baltic laboratory supplies and services provider Labochema Company Group. Financial details of the transaction remain undisclosed but investment was under тЌ3m in exchange for a significant minority stake.

IK Investment Partners hit by carried interest row

The Swedish tax authority's battle over carried interest taxation continues as another player is drawn into the feud. Sonnie Ehrendal investigates.