Nordics

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

YielCo holds closes for PE and co-investment funds

YielCo Special Situations Europe II is targeting тЌ300m; YielCo Defensive Investments targets тЌ150m

Gilde Healthcare buys majority stake in Klifo

Gilde Healthcare has now made five investments from its Gilde Healthcare Services III fund

IK sells Hansen Protection to PE-backed Survitec

IK acquired the protective clothing and equipment producer from Montagu in 2013 via IK Fund VII

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

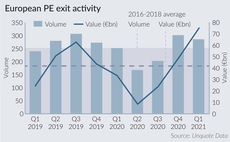

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Endeit Capital holds final close for third fund on €250m

Fund II closed on тЌ125m in 2016; Fund III will continue to invest scale-up capital in European startups

CPPIB, Fidelity lead €262m series-D round for Kry

Company was founded six years ago and has so far raised nearly тЌ500m over five rounds

PE-backed Hemnet lists in €1.15bn IPO

General Atlantic and Sprints Capital, which previously owned 60% and 17%, will remain as Hemnet's largest owners with around 41.1% and 11.8% shareholding, respectively

Triton acquires Geia Food from Credo Partners

Credo exits the company after acquiring a 55% stake in Geia in 2017

DevCo acquires minority stake in Bluefors

GP is deploying equity from DevCo Partners III, which raised тЌ180m at the end of 2019

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries

EQT closes ninth buyout fund on €15.6bn

Vehicle was launched in January 2020 and is already 40-45% deployed

AlpInvest Co-Investment Fund VIII closes on $3.5bn

ACF VIII invests alongside GPs in private equity buyouts and growth capital transactions across a variety of sectors

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Jolt, Tesi et. al in €30m round for Virta

With the funding, the Finnish company will seek to expand into Asia, which it said was one of the largest markets for EV charging alongside Europe and North America

Cusp Capital announces €300m debut fund

Newly launched VC is led by former Tengelmann Ventures partners and managing directors

Verdane appoints sustainability expert Osmundsen as partner

Erik Osmundsen will be responsible for strengthening Verdane's capabilities in sustainability