Nordics

Q&A: do not give up on the lower-mid-market, says Monument's Karl Adam

Monument partner Karl Adam tells Greg Gille how an opportunity to break through still exists for lower-mid-market managers in a very top-heavy market

Superhero Capital to close second fund by mid-summer

Fund was previously aiming for a final close by the end of 2020

THL, EQT sell stake in AutoStore to Softbank for $2.8bn

THL will continue to be a majority shareholder and EQT, which sold its majority stake to THL in 2019 but retained 10%, will also still be invested

Unquote Private Equity Podcast: Ravenous for recurring revenue

The Unquote Private Equity Podcast is back to its regular format this week, with the team looking at PE's appetite for recurring revenue models

Q4 Barometer: How European activity returned to pre-pandemic level

European PE deal value staged an impressive recovery over the course of 2020, capped by a busy Q4

MTIP holds first close for second fund

Digital-health-focused growth investor has a hard-cap of тЌ250m and target of тЌ200m for MTIP Fund II

Kartesia Senior Opportunities I holds €1bn final close

Fund provides senior financing to European small and medium-sized companies with strong credit profiles

UV T-Growth Fund holds €100m first closing

Fund targets late-stage companies, primarily across the 5G, AI, cybersecurity, cloud and Internet-of-Things sectors

L Catterton gears up for fifth European fund

Vehicle makes majority investments in companies operating across the consumer industry in Europe

Astorg Mid-Cap anticipates summer final close

Fund will make pan-European investments in mid-market companies and has a €1bn target

European GPs get top ESG marks, but diversity remains sore point - survey

Only 23% of Aberdeen Standard Investments' GPs have clear diversity targets in their portfolio companies

Back to school: education dealflow heats up as pandemic settles

Digital opportunities and long-term growth drivers have resulted in an influx of deals in recent weeks, with more in the pipeline

Industry Ventures Secondary IX closes on $850m

Fund focuses on investments in direct secondaries, LP interests, direct portfolios and tail-end funds

Nordic Capital nets strong return on €2.1bn Itiviti trade sale

GP had delisted the trading technology and services provider in 2012

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

Procuritas to net 8x on Pierce IPO

GP acquired the online motorcycle parts and accessories retailer in 2014

Semantix owner Segulah preps exit with William Blair

Semantix was originally established in 1969 and was acquired by Segulah in 2015

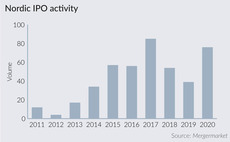

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

Armada Credit Partners closes fifth fund on €210m

Fund V is already 50% deployed and has made seven investments so far

Hg acquires Trackunit from Goldman Sachs, Gro Capital

Sale comes nearly six years after the GPs acquired the company

Capital Dynamics Global Secondaries V closes on $786m

Fund invests in a diversified portfolio of global secondaries interests in mid-market private equity funds

Klar Partners closes debut fund on €600m hard-cap

GP started raising the fund in March 2020 and said the vehicle was "significantly oversubscribed"

Nordic Capital acquires minority stake in Leo Pharma

GP's stake is reportedly smaller than 25%, with the current owner remaining as the majority shareholder

Aldea Ventures holds €60m first closing

Fund follows a hybrid strategy, investing both in small VC vehicles and technology startups