Nordics

TA Associates-backed ITRS acquires OP5

ITRS acquires OP5 from previous investors Pod Investment, Industrifonden and SEB Venture Capital

IK-backed TeleComputing acquires Excanto

TeleComputing plans on strengthening its position among Norwegian and Swedish customers

Abry's Link Mobility take-private crosses finish line

Bidder secures acceptance for 97.5% of the shares following the extension of the offer period

Kinnevik invests NOK 300m in Kolonial.no

Firm invests NOK 200m in primary capital and a further NOK 100m in secondary shares

Kinnevik leads $12m series-A for Karma

VC firms Bessemer and EVentures, and appliance manufacturer Electrolux, also take part in the round

European secondaries up 50% year-on-year – report

Western Europe deals saw the largest increase in H1 compared with other geographies, says Setter

IK prepares for minority stake fund launch

IK Investment Partners began registering vehicles for the fund in April earlier this year

Adelis-backed Søgemedier aquires Defiso Media

Acquisition gives SУИgemedier a base in Sweden, along with its investment in Danish SУИgemedier

PE delivers best returns for Keva

Finnish pension fund announces it generated returns of 7.3% from its private equity portfolio

Felicis closes sixth fund on $270m

Felicis has a global investment mandate and has previously invested in 40 countries

Nystrs considering further European fund commitments

US pension fund has increased the number of active partnerships in its private equity portfolio

Nordic Capital acquires Macrobond

Acquisition is the fifth investment by the GP's latest fund, Nordic Capital IX

Korona Invest acquires MV-Jäähdytys

Company reported net sales of тЌ6.8m in 2017 and employs a staff of 60

Strong exit environment helps drive Pantheon's returns

Sales to corporate buyers were the most significant source of exits, PIP says in its results

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

Hamilton Lane asset footprint hits record high

Firm plans to keep growing its existing funds across primary, co-investment and secondary strategies

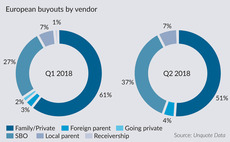

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

Capidea invests in FlexoPrint

Firm plans on growing its customer platform as GP leads the generational succession of the group

Nordic exits Unifeeder to DP World in €660m deal

Unifeeder will be integrated as a brand under the DP World umbrella, supporting its growth strategy

Sponsor Capital acquires Duell Bike Center

Duell's strategic goal is to strengthen relationships with both customers and suppliers

BGF invests £6.4m in Miss Group

Fresh capital will be used to further scale the business and drive international expansion

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

EQT pre-marketing fourth infra fund

EQT Infrastructure IV was registered in Luxembourg with several filings earlier this month

Triton acquires SKF Motion in SEK 2.75bn deal

Deal sees Stockholm-listed SKF Group divest its linear and actuation technology business to Triton