Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Astorg buys Solina from Ardian

Sale ends a five-year holding period for Ardian, which acquired Solina from IK Investment Partners

Xenon closes small-cap fund on €85m

Xenon Small Cap Fund is dedicated to investments in Italian companies generating EBITDA of up to €3m

Golding makes hires for new impact investing team

Fund-of-funds manager is to launch its first impact fund in H2 2021, having hired the team of Sonanz

Perwyn opens Paris office, eyes more investment on the continent

Firm has already made two investments in France: Isla Delice in 2018 and Keobiz in 2020

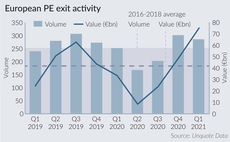

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Hg's MeinAuto sets IPO price range

Shares are each priced in the €16-20 range, corresponding to a €1.2-1.5bn market capitalisation

Seco floats in €397m IPO

Sellers include FII, which owns a stake in Seco via its Fitec fund, and the company's founders

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

Hannover Finanz, Arcus acquire Löwenstark

Mittelstand-focused GPs aim to support the online marketing firm's growth and succession planning

Amadeus V Technology Fund closes on £110m

Fund invests in seed and series-A startups specialised in science and engineering-led innovation

Kramer Levin hires Eversheds team for French PE, financing practices

Law firm adds five lawyers to its private equity and banking/finance practices in Paris

Hg sells EidosMedia to Capza

Sale ends a six-year holding period for Hg, which acquired a majority stake in Eidosmedia firms Wise and Aksia

Flexstone reaches $322m second close for co-invest fund

Firm is gearing up to announce a fourth co-investment deal for Global Opportunities IV in May

GP Profile: Quadrivio plots busy investment schedule for 2021

Quadrivio co-founding partner and CEO Walter Ricciotti discusses the firm's latest fundraises, portfolio performance and upcoming investment pipeline

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Gimv buys minority stake in Projective Group

Digitalisation consultancy and recruitment business intends to pursue a buy-and-build strategy

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Meridia exits food ingredients producer Sosa

This is the second exit inked by the GP's debut fund, Meridia Private Equity I, following the sale of KIpenzi

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

Paragon-backed Apontis Pharma sets IPO price range

Shares are priced at €18.5-24.5, with a final pricing expected on 6 May before the 11 May listing

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Corpfin sells Secna to EQT's Chr Hansen

Sale ends a six-year holding period for Corpfin, which bought a 51% stake in the company via its €255m fund IV