Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

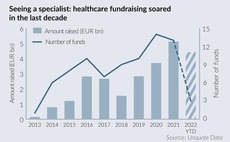

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Pemberton launches NAV financing strategy with new hire

Thomas Doyle joins alternative credit specialist from 17Capital

Aztec appoints new head of ESG

Caroline Mantoura joins the fund services provider after 12 years at Accenture

Access holds EUR 375m first close for ninth flagship fund

Managing partner Philippe Poggioli speaks to Unquote about the Access Capital Partners' small-cap buyout fund-of-funds strategy and the GP's latest fundraise

Nordwind reaches first close for debut technology fund

GP has been making technology investments deal-by-deal since 2012 and is now raising a EUR 160m fund

CVC dribbles past Silver Lake, Oaktree, H&F to score Ligue 1 deal

Deal for 13% in French football league commercial arm will add to sponsor's collection of sports assets

General Atlantic appoints head of ESG from PAI

Cornelia Gomez joins with an aim to bolster the sponsorтs ESG efforts and will be based in London

Main Capital creates software group enventa after four DACH deals

With EUR 25m in combined revenues, new buy-and-build platform will focus on ERP, business intelligence and financial solutions

Adelis launches majority stake sale of Knightec

GP is being guided by Carnegie in the exit from the Swedish technology consultancy

Reckitt Benckiser baby nutrition carve-out likely to attract sponsors

Goldman Sachs is advising on the process for the infant formula maker, which could be valued at GBP 6bn

NorthEdge appoints two new partners amid several senior promotions

UK GP bolsters teams in Manchester, Leeds and Birmingham with 80% of Fund III to invest and over 50% of its SME vehicle deployed

Polaris Investment Advisory makes board appointments

Eon's Dajana Brodmann, Axiom's Marc Lau and Omega Capital's Pablo López de Ayala bolster the board

Epiris acquires Inchcape Shipping Services in SBO

Deal for London-based maritime services provider marks the 10th investment by Epiris Fund II

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

Pinova Capital promotes Hofbauer to partner

Jean-Marie Hofbauer joined the Munich-headquartered Mittelstand technology investor in 2015

Segulah sells NVBS Rail Group to Ratos

Exit sees NVBS acquire Finland-based Ratatek; the group's EV is EUR 103m with a 9.4x EBITDA multiple

AP Moller, Biogroup among final bidders for Waypoint's Affidea

Final offers for the pan-European outpatient group are expected in a couple of weeks

Soho Square explores Alpine Fire Engineers sale

Clearwater is advising on the upcoming auction for the Manchester-based provider of active fire sprinkling systems

KSL Capital acquires Pig Hotels

Travel and leisure-focused GP plans to expand the boutique hotel chain across the UK with acquisitions and development

Ufenau VII closes on EUR 1bn hard-cap

Switzerland-based buy-and-build specialist plans to make 13-15 platform deals from the fund

FSN readies IT consultancy Nordlo for exit

Danske Bank is among advisers in the upcoming auction, which could see the Sweden-based asset marketed off EUR 25m-30m EBITDA

Findos exits Karriere Tutor to Trill Impact

The GP has sold the German digital training provider just a year after entry; fifth platform deal for Trill Impact

Hg invests in EQT, TA backed IFS and WorkWave

EQT VIII exits majority of its positions and reaps 3x money after two years invested in the cloud software companies

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact