Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Polaris holds first close for Flexible Capital fund on DKK 500m

Vehicle was launched in May 2021 with a target of DKK 1bn and is expected to start deploying capital this quarter

Eight Advisory opens Cologne office; appoints KPMG's Luchtenberg

Fourth German office will be headed by Curt-Oliver Luchtenberg, who has joined from KPMG

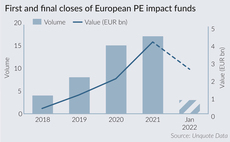

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

EIM acquires Bonna Sabla from Bain-backed Consolis

Carve-out of the precast concrete manufacturer follows 20 years of private equity ownership

Abac exits PronoKal to Nestlé Health Science for EUR 100m

GP first bought 100% of the share capital in 2017

Polaris mandates EY to exit Det Danske Madhus

Formal sale launch is expected once updated financial figures for the Danish catering company are in

TA Associates prepares Odealim for H2 exit

Lazard is likely to be mandated for the sale of the French insurance brokerage firm

Baird sells Nigel Wright majority stake to management

Baird will retain minority stakes in the recruitment firm, having first acquired it in 2010

Tikehau records EUR 6.4bn in fundraising in 2021

GP deployed EUR 5.5bn from its private equity, private debt and real estate funds in the same year

SuperSeed launches GBP 50m seed-stage fund

The VC firm has already held a first close at GBP 31m

HIG acquires screws and bolts distributor Berardi Bullonerie

The investment will support an acquisition strategy to accelerate growth

Blackstone weighs sale of casino operator JOA Groupe

Discussions were prompted by inbound proposals from trade players

Omers' Trescal to hit auction block in H2 2022

DC advisory will guide the French calibration services specialist in its upcoming sale

Holland Capital buys business applications provider Appronto

Acquisition will enable close collaboration with other companies in the GP's portfolio

Access Capital registers ninth growth buyout fund

Fund-of-funds strategy makes primary and secondaries deals, backing funds investing in European SMEs

CapMan commits to science-based targets for net zero

Commitment is part of the GP's ESG strategy across the firm itself and its portfolio

ArchiMed nets 4x return on Fytexia exit

GP has sold Fytexia to trade Associated British Foods

Coller to close USD 1.4bn debut credit secondaries fund

GP launched its first dedicated secondaries fund in May 2021 and has commitments from around 30 LPs

Five Arrows Growth Capital leads EUR 80m fundraise for Padoa

Kamet Ventures will retain a majority stake in the startup

Activa acquires Rhétorès, Cap Fidelis

GP plans to be ahead of the consolidation phase in the financial advisory market, which it believes is underway

Nordic Capital bolsters team with seven promotions

Among the appointments, Chris Lodge and Peter Thorninger are promoted to partners

Syz, Saturnus buy SK Pharma

Pharmaceutical wholesaler has been growing at a 28% compound annual growth rate

Inspired Education stake sale attracts Blackstone, EQT, H&F, KKR

Information memorandums for the GIC- and TA Associates-backed national schooling company should be circulated next week

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds